We recently wrote that the House of Representatives’ new tax blueprint would jeopardize estate planning techniques that wealthy families have long relied upon. But the House proposal sharply increases income and capital gains tax rates as well.

Under the House’s draft legislation, released in mid-September, certain wealthy taxpayers could face a combined federal rate as high as 46.4%. Meanwhile, a higher capital gains rate, combined with the NIIT tax (often referred to as the Obamacare tax) and a new surtax on the highest earners, could mean a 31.8% rate on very wealthy households’ investment income.

Let’s break down the proposed federal taxes to understand exactly how some taxpayers could wind up owing more.

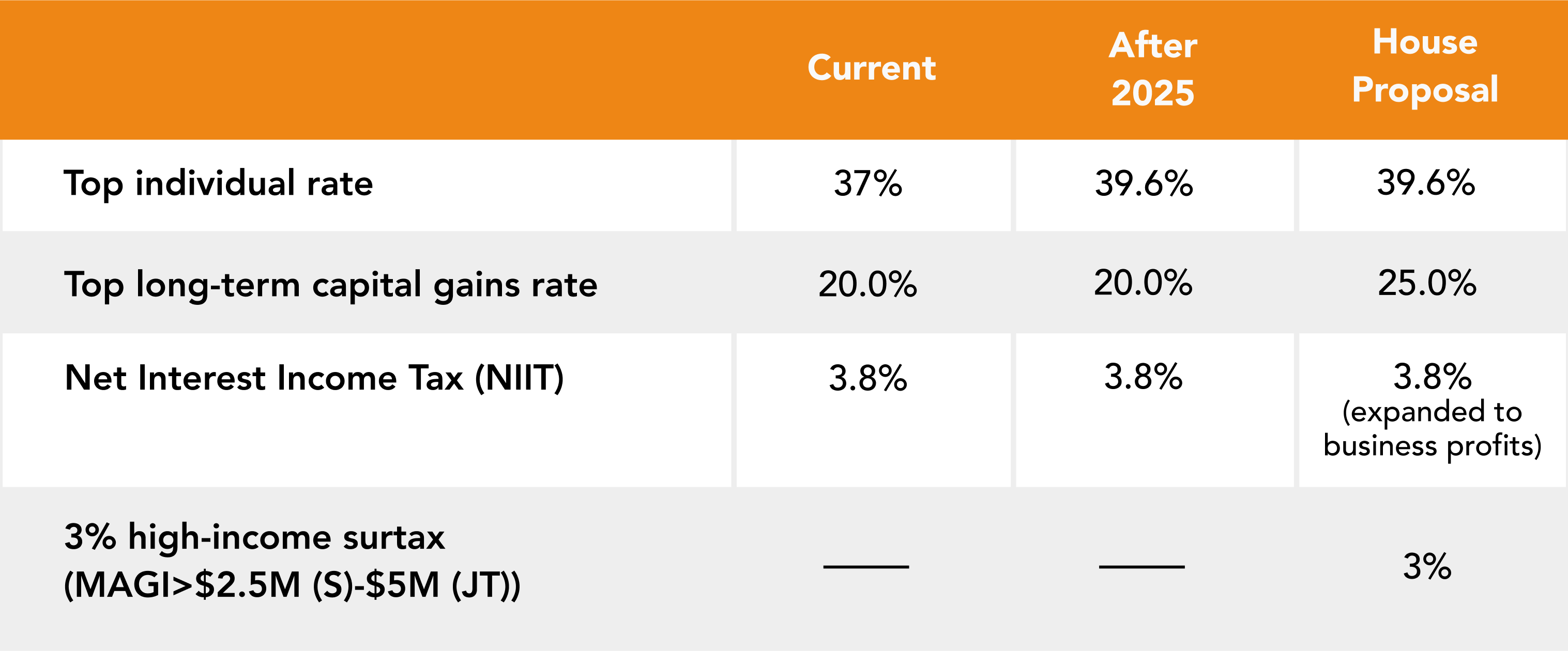

How Your Taxes Might Change

First let’s look at income taxes, the parameters of which were set under the 2017 Tax Cuts and Jobs Act (TCJA). The top individual rate is currently 37%, and it applies to individuals earning more than $523,600 and married couples earning more than $628,300. Like most of the provisions in the TCJA, this one is scheduled to expire at the end of 2025, returning top income tax rates to their previous level of 39.6%. Under the plan from the House’s Ways and Means Committee, the top rate would revert at the beginning of 2022, and it would apply to single filers with incomes over $400,000 and married joint filers over $450,000. House Democrats also want to institute a 3% surtax on modified adjusted gross income over $5 million for single filers and married couples filing jointly (or $2.5 million for married couples filing separately, and $100,000 for trusts). Those taxpayers would be looking at a combined 42.6% rate. Finally, the House proposal calls for expanding the 3.8% Obamacare tax from passive investment income to active business income for high earners. Under that trifecta, certain wealthy taxpayers would pay a total rate of 46.4%.

Now let’s look at what could be in store for capital gains. The Ways and Means proposal raises the rate on gains from investments held for at least a year to 25% from 20%– retroactive to Sept. 13, 2021. The proposed rate is far less than the 39.6% that would have applied if President Biden had gotten his wish of taxing capital gains at earned-income rates. But it’s still a 25% increase, and those above the income thresholds would also be subject to the 3% surtax. Combined with the 3.8% net investment income tax, the effective rate on capital gains would rise to 31.8%.

The bottom line is that if you’re a wealthy family, the House panel’s tax plans mean significantly higher taxes. It’s very likely that whatever law President Biden signs will look different from the House proposal. The Senate hasn’t yet issued its own tax plan, after all. And the high degree of legislative infighting lately among Democrats, who control the House and Senate by razor-thin margins, means compromises are likely.

To learn more about how the House’s plan would affect wealthy families’ estate planning, see our recent explainer. But to quickly recap, it would mortally wound the techniques used to protect and transfer family wealth. Under the legislation:

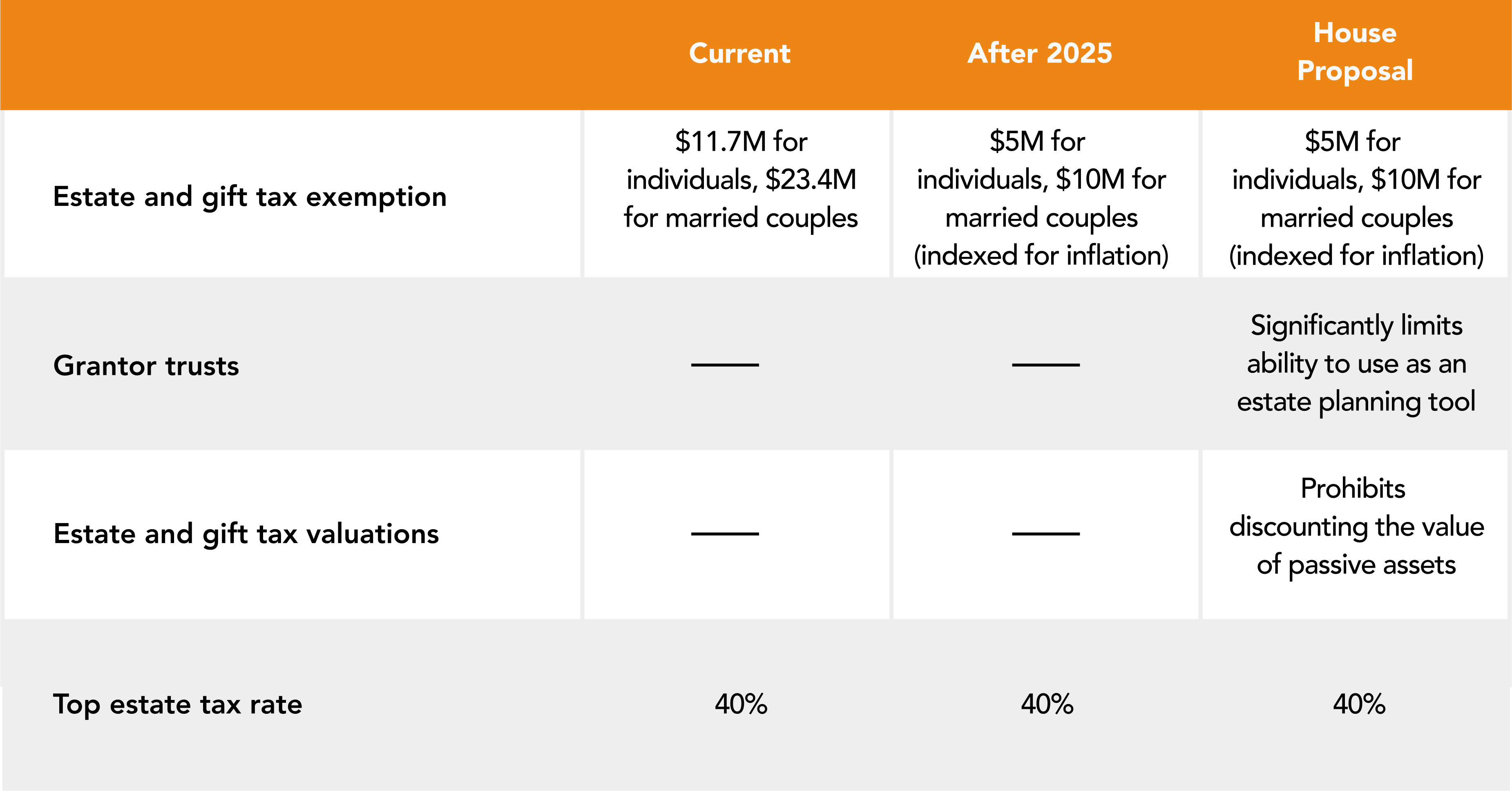

Possible Tax Changes for Trusts and Estates

- The lifetime estate/gift tax exemption would be halved, from $23.4 million for a married couple. A 40% estate or gift tax kicks in above that threshold.

- Changes to grantor trusts would undercut their usefulness in excluding assets from estates.

- The ability to move passive investment assets into corporate entities to claim a valuation discount would be eliminated.

Finally, the House proposal contains a few provisions that haven’t made headlines but could affect certain taxpayers:

- Phaseout of Section 199A deduction: Section 199A allows a deduction of up to 20% of qualified domestic business income for passthrough entities such as sole-proprietorships, partnerships, S-corporations, trusts and estates. The House legislation limits the maximum deduction to $500,000 per year for married couples filing jointly, $400,000 per year for individuals, and $10,000 per year for trusts and estates.

- Elimination of excess business losses: The House bill would make permanent a change that disallows noncorporate taxpayers from using excess business losses (i.e., when business deductions exceed business income) to offset non-business income in a taxable year. The provision pertains to losses in excess of $250,000 for single filers and $500,000 for married couples filing jointly. Any disallowed losses would be carried forward to future tax years and subject to the excess business loss limitations in that year.

- Carried interest: General partners of hedge funds or private equity funds currently must wait three years before selling their carried interest in order to pay the lower long-term capital gains tax rate. That period would be extended to five years for taxpayers with annual adjusted gross incomes above $400,000.

Again, the lawmaking process in Washington is fluid, and there’s a chance the outlook could improve. But we believe the maxim “hope for best and plan for worst” applies here. We advise you to be in touch with your tax professional and financial advisor if you believe any of the changes described above could affect you.