Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Powell’s Pivot

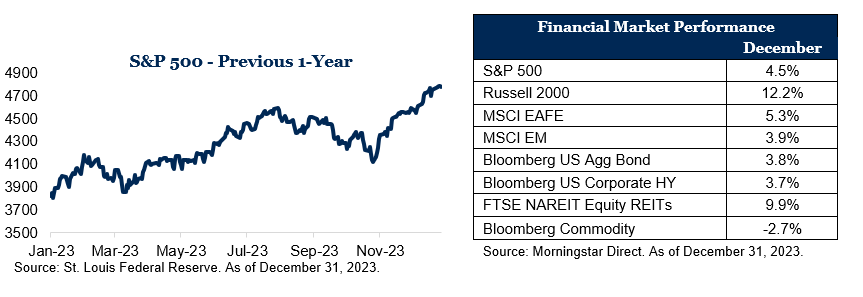

After its policy meeting in early December, the Federal Reserve released projections of at least three interest rate cuts in 2024. U.S. stocks soared, led by growth stocks, while international stocks rose by a similar amount. Fed officials said it’s too early to declare victory but generally supported the idea that this rate cycle has likely peaked.

Key Observations

- The S&P 500 gained nearly 5% in December and is up more than 26% year to date.

- Small-cap stocks rose 12% and mid-cap stocks rose nearly 8% for the month.

- Bonds ended the month up about 4%.

- International developed and emerging markets rose 5% and 3.9%, respectively.

Market Recap

The stock market had another great month in December as markets soared in reaction to the Federal Reserve’s guidance. The S&P 500 gained nearly 5% and is now up more than 26% year to date. The Bloomberg U.S. Aggregate Bond Index was up 4% for the month, while the 10-year Treasury yield tumbled. Yields on the 2-year Treasury declined in December, starting at 4.57% and falling to 4.25%. The 10-year Treasury yield dropped from 4.23% to 3.87%. High-yield bonds were up 3.7%. Small- and mid-cap stocks rose 12% and 8%, respectively. International markets ended the month up 5%.

Job Market Cools While Inflation Edges Lower?

The U.S. job market slowed again in November but remains robust. Employers added a seasonally adjusted 199,000 jobs in November, slower than earlier in the year but consistent with gains before the pandemic. When excluding the effects of the recent autoworker strikes, November’s job gain was roughly 169,000, less than the 180,000 gain in October. Hiring was concentrated in health care and government. Other data showed the labor market remains strong. The unemployment rate fell to 3.7% from 3.9% in October while a half-million more Americans entered the labor force. On a monthly basis, hourly earnings rose 4% from a year earlier.

Home sales rose from 13-year lows in November after five consecutive months of declines. Existing-home sales increased 0.8% in November from the prior month to a seasonally adjusted annual rate of 3.82 million, according to the National Association of Realtors. November sales were still down 7.3% from a month earlier. Existing-home sales for the full year in 2023 are on track to be the lowest since at least 2011 due to poor affordability and high mortgage rates.

Personal spending increased 0.1% in November from the prior month, according to the Commerce Department. The report followed a much stronger 0.9% increase in October. Households boosted spending on services while cutting spending on goods, including autos. Meanwhile, U.S. retail sales rose a seasonally adjusted 0.3% in November from the month before, according to the Commerce Department. That was a rebound from October’s revised 0.2% decline. The retail report mainly captures spending on goods sold at stores and online rather than on most services, such as housing, utilities and medical care.

The Consumer Price Index rose 3.1% in November from a year earlier. Core prices, which strip out volatile food and energy components, rose 0.3% from the prior month. Core inflation was 2.9% at a six-month annualized rate in November, down from 5.1% for the six-month period before that. The news was well received by financial markets, reflecting the belief that the Fed has made good progress in its fight against inflation. Meanwhile, the Fed’s preferred inflation gauge, the Personal Consumption Expenditures Index, fell 0.1% in November from the previous month, the first decline since April 2020, according to the Commerce Department. Prices were up 2.6% for the year, not far from the Fed’s 2% target. Core prices were up just 1.9% on a six-month annualized basis.

Low unemployment, moderating job gains and easing inflation are consistent with a so-called soft landing, where inflation cools without triggering a recession.

Rebalancing – A Better Strategy Than Market Timing

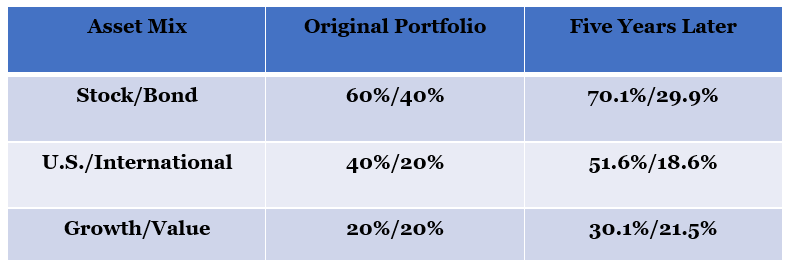

If you haven’t rebalanced your portfolio in the last few years, you may be taking risks you didn’t even realize. The last five years have been very kind to U.S. stocks—especially U.S. large-cap growth stocks. The table below shows what would have happened to a balanced portfolio that was simply left alone. As you can see, a portfolio that originally had a 60% weighting in stocks and 40% in bonds is now closer to a weighting of 70% in stocks and 30% in bonds. If the 60% weighting in stocks was originally divided 40/20 between U.S. and international holdings, it now has more than 50% in U.S. stocks. If the stock portion was equally balanced between growth and value, it now has a 10% overweight in growth.

It might feel good to have more of your portfolio in the “winners,” but there is a reason why we say, “Past performance may not be an indicator of future results.” There is a cycle to markets, and the future may look quite different from the recent past. Investing by looking in the rear-view mirror can be a big mistake when the cycle turns. Rebalancing the portfolio involves trimming some of your winners and adding to some of your losers to bring your portfolio back into balance. In other words, you may be “buying low and selling high” instead of the opposite. If you don’t rebalance your portfolio, your stocks may be overweight the so-called Magnificent Seven tech stocks (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, Tesla). As we mentioned last month, those stocks now account for 29% of the S&P 500. That’s a lot of concentration in just seven names. We believe the future is very bright for these companies, but having too much in so few companies may not be appropriate for investors who are trying to manage risk.

Source: Morningstar, as of November 30, 2023.

Outlook

A psychological study showed that people who had no formal training in flying a plane felt confident they could do so successfully after watching a brief YouTube video. The study, which appeared in New Scientist magazine, was conducted by Maryanne Garry and her colleagues at the University of Waikato in New Zealand. The researchers asked half of their 780 volunteers to watch a four-minute silent video showing two commercial pilots landing a plane in a mountainous area. They found that people who had watched the video were up to 30% more confident in their ability to land a plane without dying. But even people who hadn’t watched the video gave themselves an average confidence score of 29% for their ability to land the plane without dying. In general, men were significantly more confident than women. Overconfidence can be a detriment when performing important tasks—like landing a plane or managing an investment portfolio. Pundits and prognosticators can be quite confident in their forecasts of how the markets will perform in the new year. But listeners should beware—their track record in predicting the future is spotty at best.

Rather than worry about what the stock market will do this year, investors should instead focus on factors they can control. Rebalancing the portfolio back to your target level of risk and making sure it is properly diversified is a sensible strategy that should pay dividends in the long run.

Disclosures:

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or recommendation. References to specific companies, asset classes, and financial markets are for illustrative purposes only. Rebalancing and diversification are investment strategies designed to help manage risk but they cannot ensure a profit or protect against loss in a declining market. Also, rebalancing may have tax consequences and transaction costs associated with it so please consult a financial professional before making any financial-related decisions.

The commentary represents an assessment of the market environment through December 2023. The views and opinions expressed may change based on the market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize. This commentary was written and provided by an unaffiliated third party; we cannot guarantee the accuracy or completeness of any statements or data contained herein.

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Index Definitions: The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index. MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs. Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume, and 1/3 by world production and weight-caps are applied at the commodity, sector, and group level for diversification.

Does past performance matter?

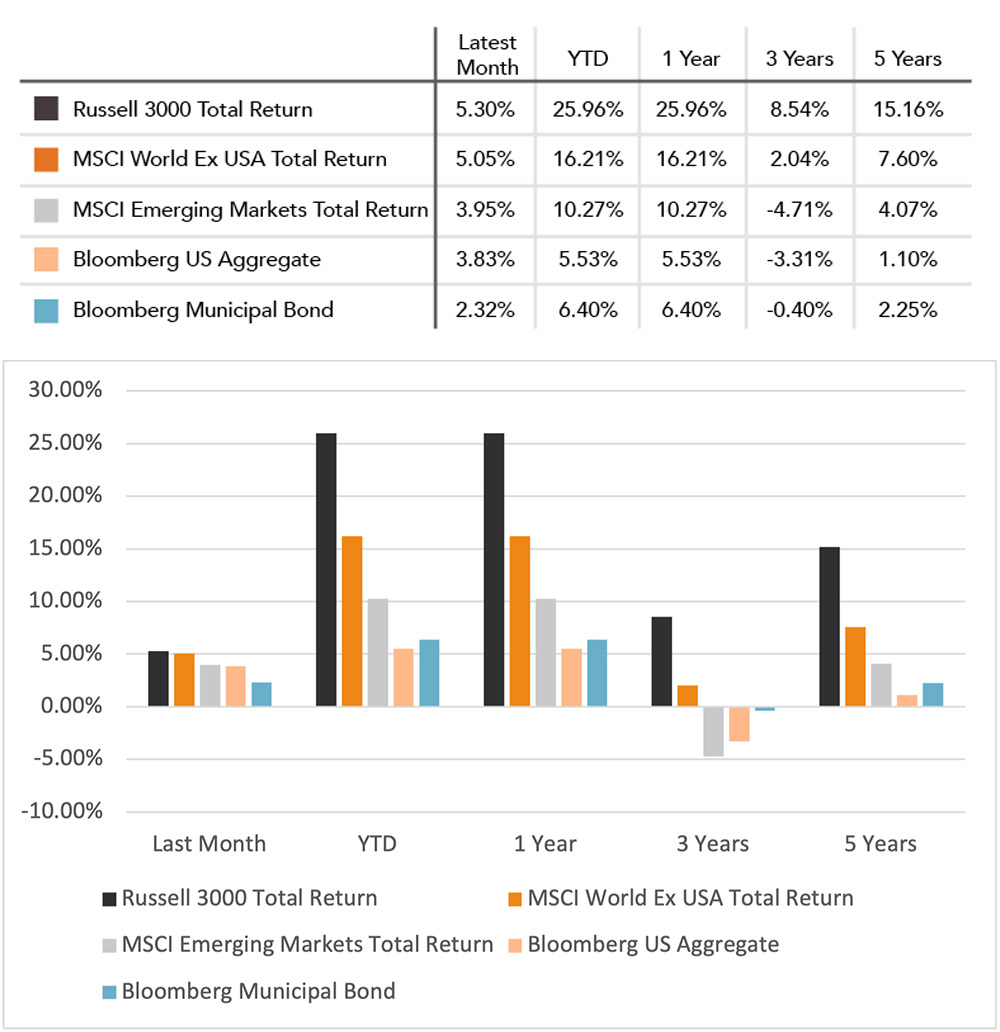

Major Market Index Returns

Period Ending 1/1/2024

Multi-year returns are annualized.

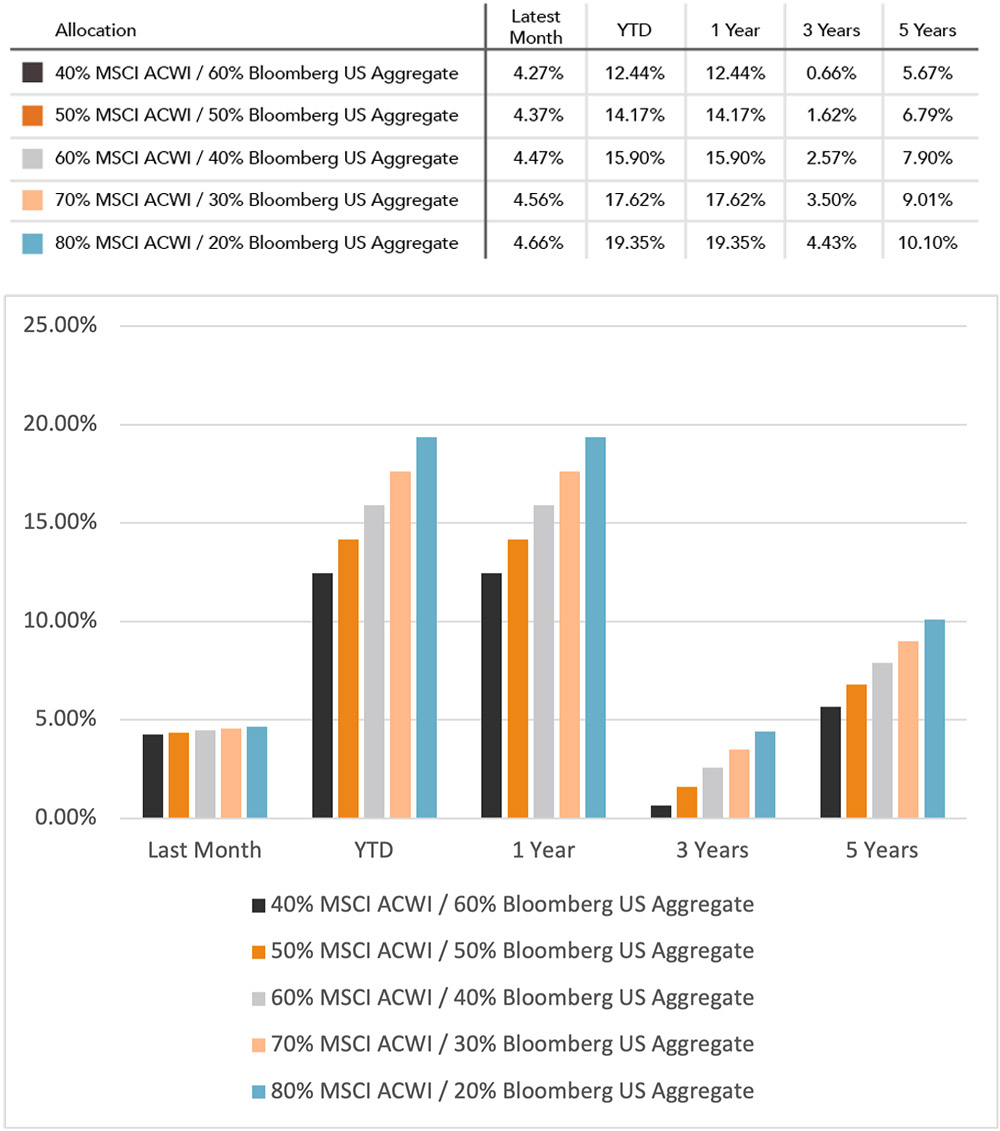

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

November 2024 Market Commentary