Whether you’ve dreamed about retiring to a sunny location with a beach or have decided to stay put to be near family, as you save for the retirement you’ve always wanted, beware of 5 factors that could derail your dreams unless you plan ahead.

1. Housing Costs

If you’re an empty nester and own your primary residence, you may find yourself with too much house in retirement. In that case, think about downsizing to a smaller and possibly less-expensive home or even renting.

Also, if you plan to buy or currently own a second home for vacations, rental income or an eventual retirement residence, keep in mind that you may receive tax deductions for mortgage interest, property taxes and rental expenses.

2. Health Care Costs

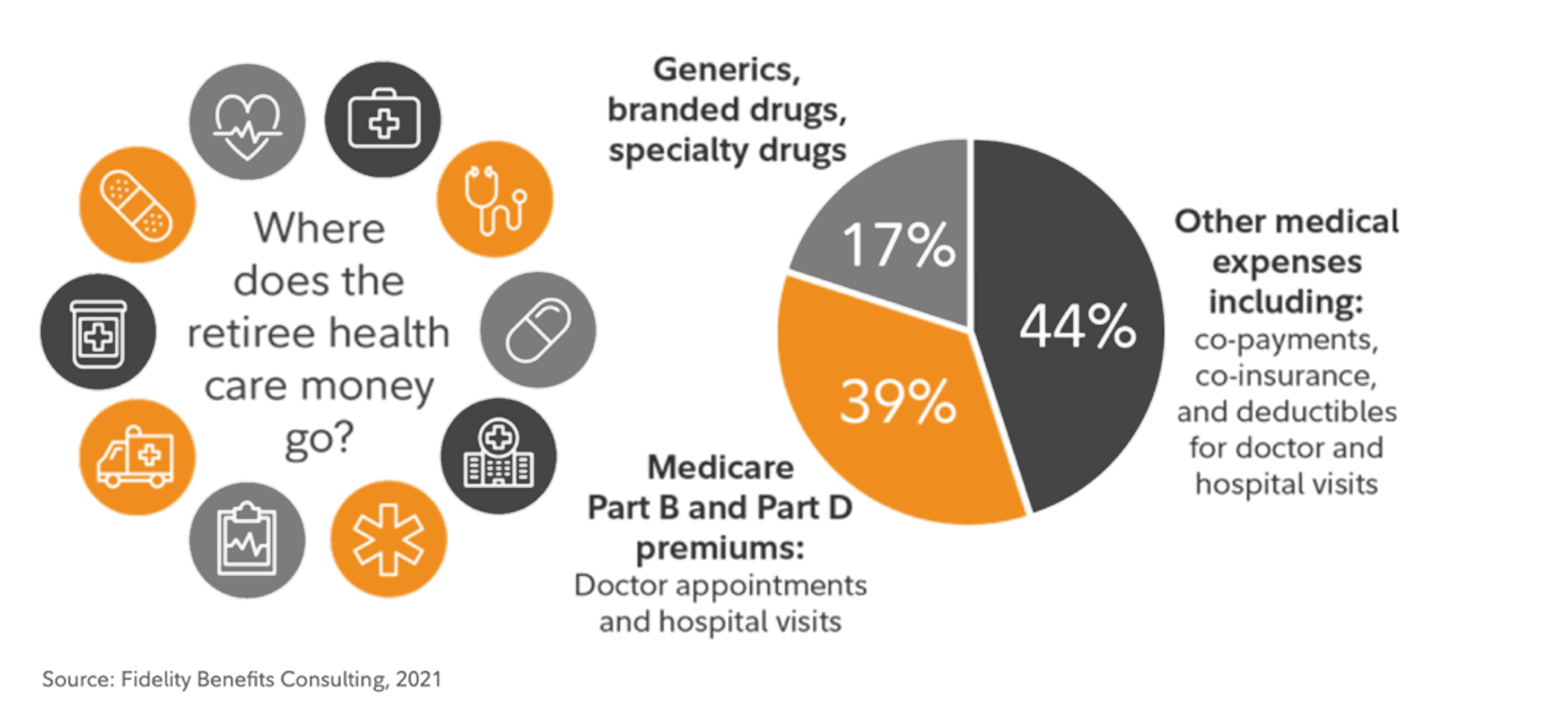

The rising cost of health care remains the biggest wild card when it comes to planning for retirement. On top of the uncertainty about your out-of-pocket costs, there is the uncertainty about your longevity. The lifetime health care costs for most couples who retired in 2021 ranged from $156,208 to $1,022,997.1 Given that people are living longer today than previous generations, it’s a good idea to prepare sooner than later for a longer life.

That could mean maxing out your annual IRA and 401(k) retirement plan contributions as well as participating in a health savings account (HSA). HSAs are portable from employer to employer while you’re working and, once you turn 65, can be used to pay for any expenses, including Medicare premiums.

Lastly, consider that 7 out of 10 people will require long-term care. According to Genworth, the median annual cost of a private room in a nursing home in 2021 was $108,405.2 Work with your advisor to determine if it makes sense to fund long-term care from personal investments, a permanent life insurance policy, a 1035 exchange or an annuity.

3. Day-to-Day Living Expenses

Although spending on food, clothing and transportation tends to remain relatively stable as people transition from working life to retirement, currently, rising inflation is impacting how much everyone is paying for these necessities, eroding purchasing power. Over the longer term, inflation can undercut the value of your retirement savings and income.

During periods of rising inflation, it’s impossible to predict how high inflation will go or how long it will last. For that reason, you’ll want to factor the long-term average inflation rate, around 3%,3 into your plan and adjust your annual retirement income accordingly.

4. Travel & Entertainment

According to financial experts, retirees will need 80%4 of their pre-retirement income to maintain their standard of living during their post-work years. But if you’re planning to enjoy an active lifestyle in retirement that includes foreign travel and luxury entertainment, think about boosting your savings goal to 90% or perhaps even 100% of your annual income while working.

Also, given that inflation has pushed up prices on everything from first-class air travel to 5-star hotel accommodations and from Michelin-ranked dining to the hottest theater tickets on Broadway, you may want to factor those higher travel and entertainment costs into your retirement savings plan.

5. Life Insurance

If you’re the primary financial provider and want to make sure your loved ones are cared for should the unexpected happen to you, consider adding a term life insurance policy. Often, employers offer basic insurance, but you may need supplemental coverage. Note that although you avoid a medical exam, your employer may place limits on that additional coverage.

With a term life insurance policy, you pay a premium for a period of time—typically between 10 and 30 years—and if you die during that time, a cash benefit is paid to your family (or anyone else you name as your beneficiary).

Meet With Your Wealth Advisor

The success of any savings plan starts with knowing how much you’re spending monthly, both in fixed and discretionary expenses. Understanding your cash flow will enable you to allocate your income appropriately in retirement and to make adjustments when necessary.

Our wealth advisors can help you plan ahead and address the factors that could derail the golden retirement you envision. If you’re near retirement or already there, consider setting a time to meet with your advisor to review your plan and fine-tune it if needed to keep you on track.

Footnotes

1“2021 Retirement Healthcare Costs Data Report.”

2“Cost of Care Trends & Insights.”

3“U.S. Inflation Rate Reaches 8.6%.”

4“How Much Do I Need to Retire?”

The information contained herein is not intended to be personalized investment or tax advice or a solicitation to engage in a particular investment strategy. The views expressed are for informational and educational purposes only and do not consider any individual personal, financial, or tax considerations. Please consult a financial professional before making any financial-related decisions.

Insurance benefits and guarantees are subject to the financial strength and claims-paying ability of the issuing insurance company.

Because the administration of an HSA is a taxpayer’s responsibility, you are strongly encouraged to consult your tax advisor before opening an HSA. You are also encouraged to review information available from the Internal Revenue Service (IRS) for taxpayers, which can be found on the IRS website at IRS.gov.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.