Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Positive Sentiment Drives Markets Higher

Gains Fueled by Tech and Finance Sectors

Settled election and expectation of lower interest rates power record performance

Key Observations

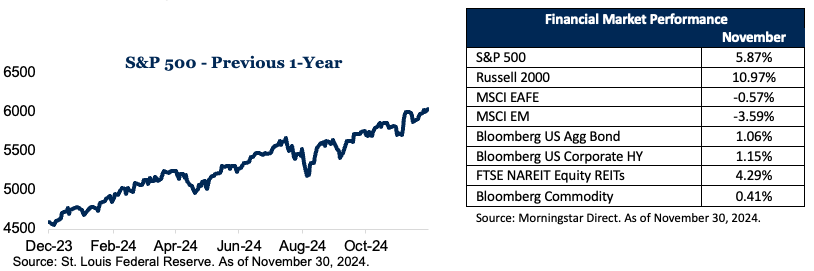

- The Dow Jones Industrial Average rose by an impressive 7.74% in November, marking its best month of 2024.

- The S&P 500 gained 5.87%, while the Nasdaq Composite soared by over 6%.

- The Russell 2000, focused on smaller companies, outperformed with a remarkable 10.97% surge.

Market Recap

As we wrap up November 2024, we’re pleased to share these market developments and reinforce key investment principles that continue to serve our clients well.

As we wrap up November 2024, we’re pleased to share these market developments and reinforce key investment principles that continue to serve our clients well.

The Power of Diversification

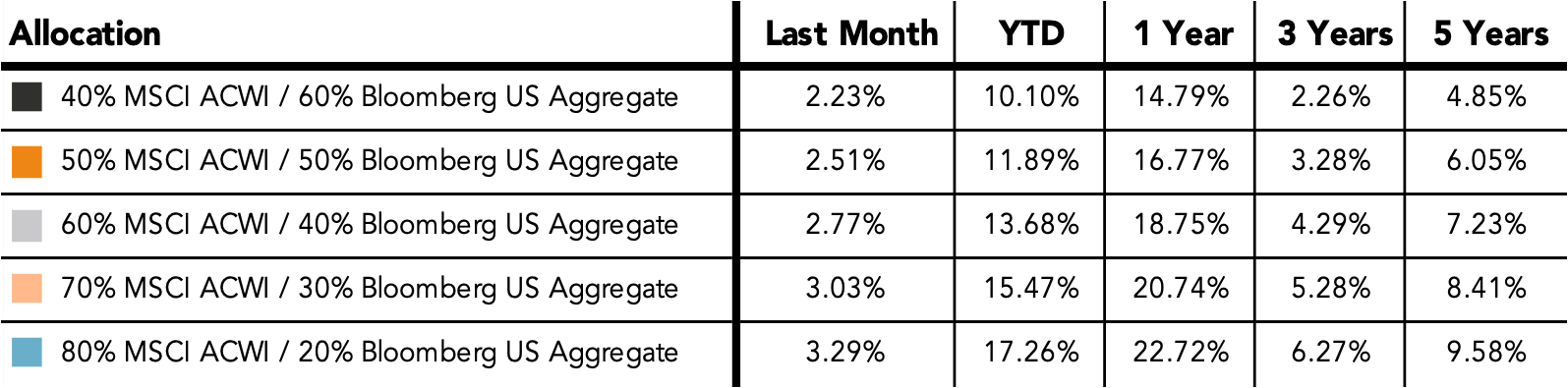

While the market gains highlighted above are certainly encouraging, they also serve as a reminder of the importance of diversification in your investment strategy. Diversification is not just about spreading risk; it’s also about positioning your portfolio to capture gains across different market segments.

Consider the following:

- Different sectors performed well this month, from technology stocks like Apple and Tesla to financial services companies like Discover Financial Services.

- The outperformance of small-cap stocks (Russell 2000) alongside large-cap indices demonstrates the value of exposure to various market capitalizations.

By maintaining a diversified portfolio, you’re seeking to protect against potential downturns in any single sector or asset class as well as positioning yourself to potentially benefit from growth opportunities across the market.

The Virtue of Patience

While it’s natural to feel excited about short-term gains, it’s crucial to remember that investing is a long-term endeavor. The market’s strong performance in November underscores the importance of patience and staying invested.

Consider these points:

- Market timing is notoriously difficult. Those who remained invested through previous periods of uncertainty were well-positioned to benefit from this month’s gains.

- Long-term investors can benefit from compound growth over time, which can significantly enhance returns.

Looking Ahead

As we move into the final month of 2024, we remain committed to helping you navigate the markets with a balanced, long-term approach. While we celebrate the recent gains, we also maintain our focus on your overall financial goals and risk tolerance.

Remember, a well-diversified portfolio and a patient, disciplined approach are your best tools for long-term investing success.

Disclosures:

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or recommendation. References to specific asset classes and securities are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell any securities or assets classes.

The commentary represents an assessment of the market environment through November 2024. The views and opinions expressed may change based on the market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize. Diversification is an investment strategy designed to help manage risk, but it cannot ensure a profit or protect against loss in a declining market.

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Index Definitions: The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index. MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs. Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume, and 1/3 by world production and weight-caps are applied at the commodity, sector, and group level for diversification.

Does past performance matter?

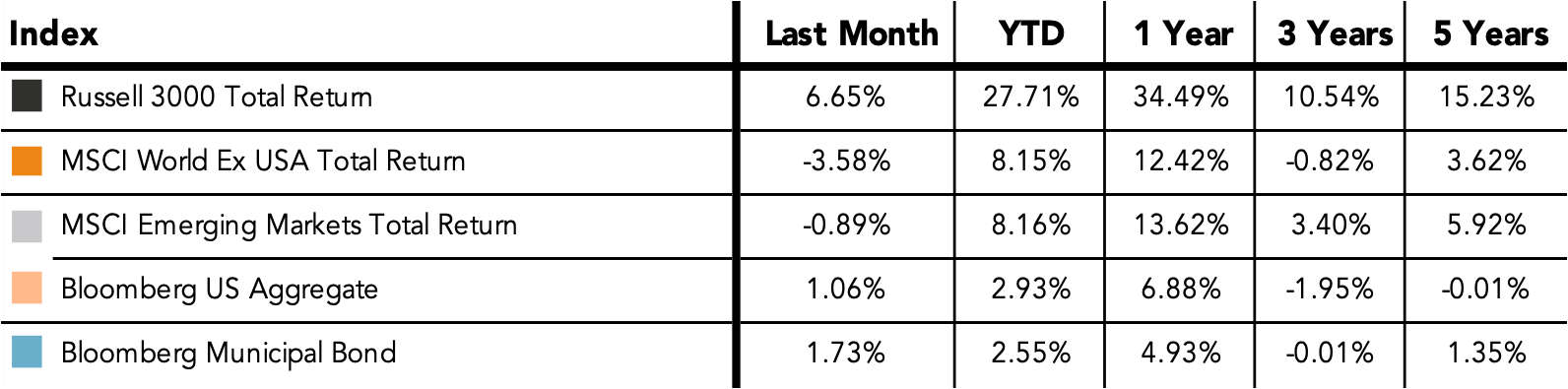

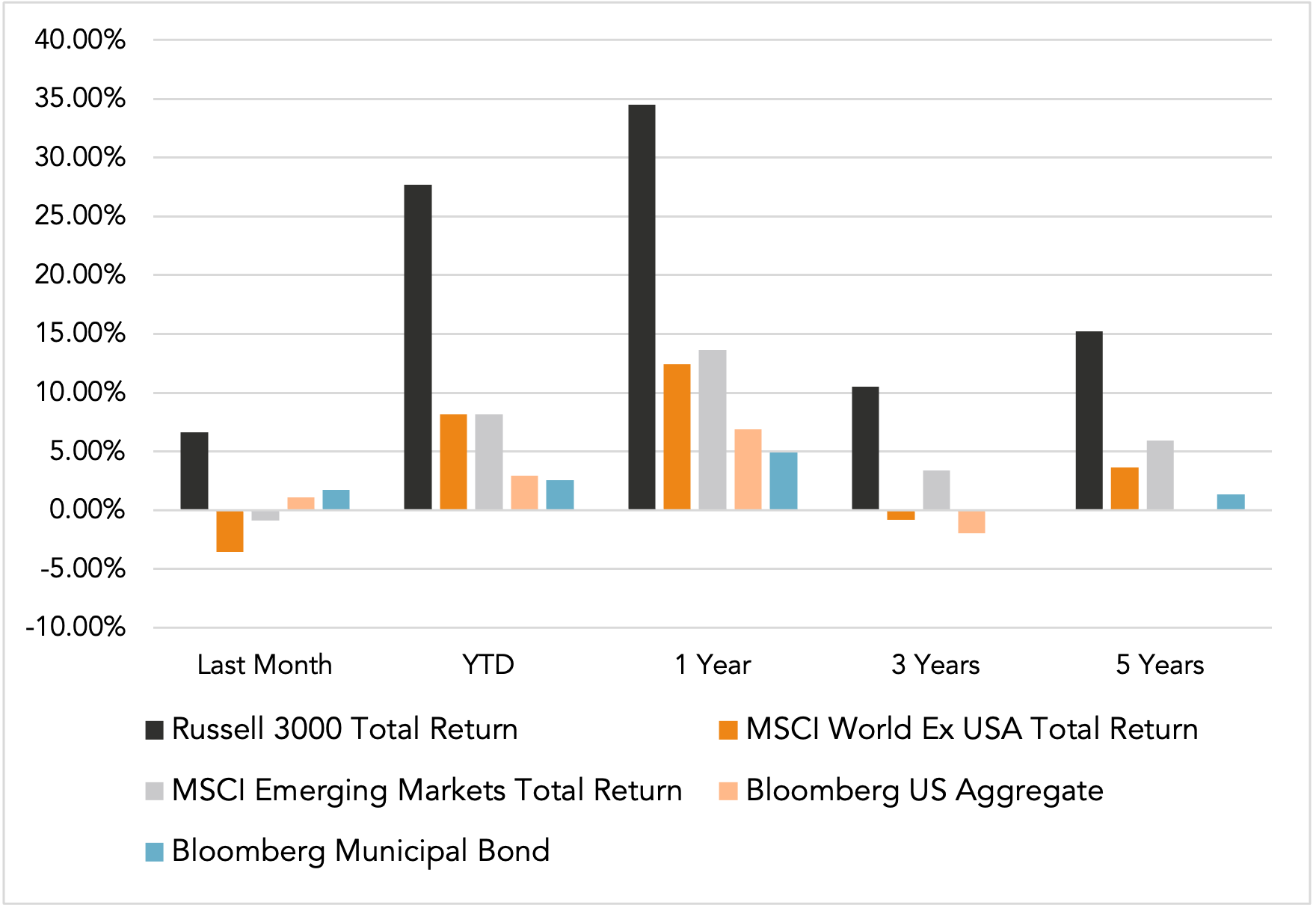

Major Market Index Returns

Period Ending 12/1/2024

Multi-year returns are annualized.

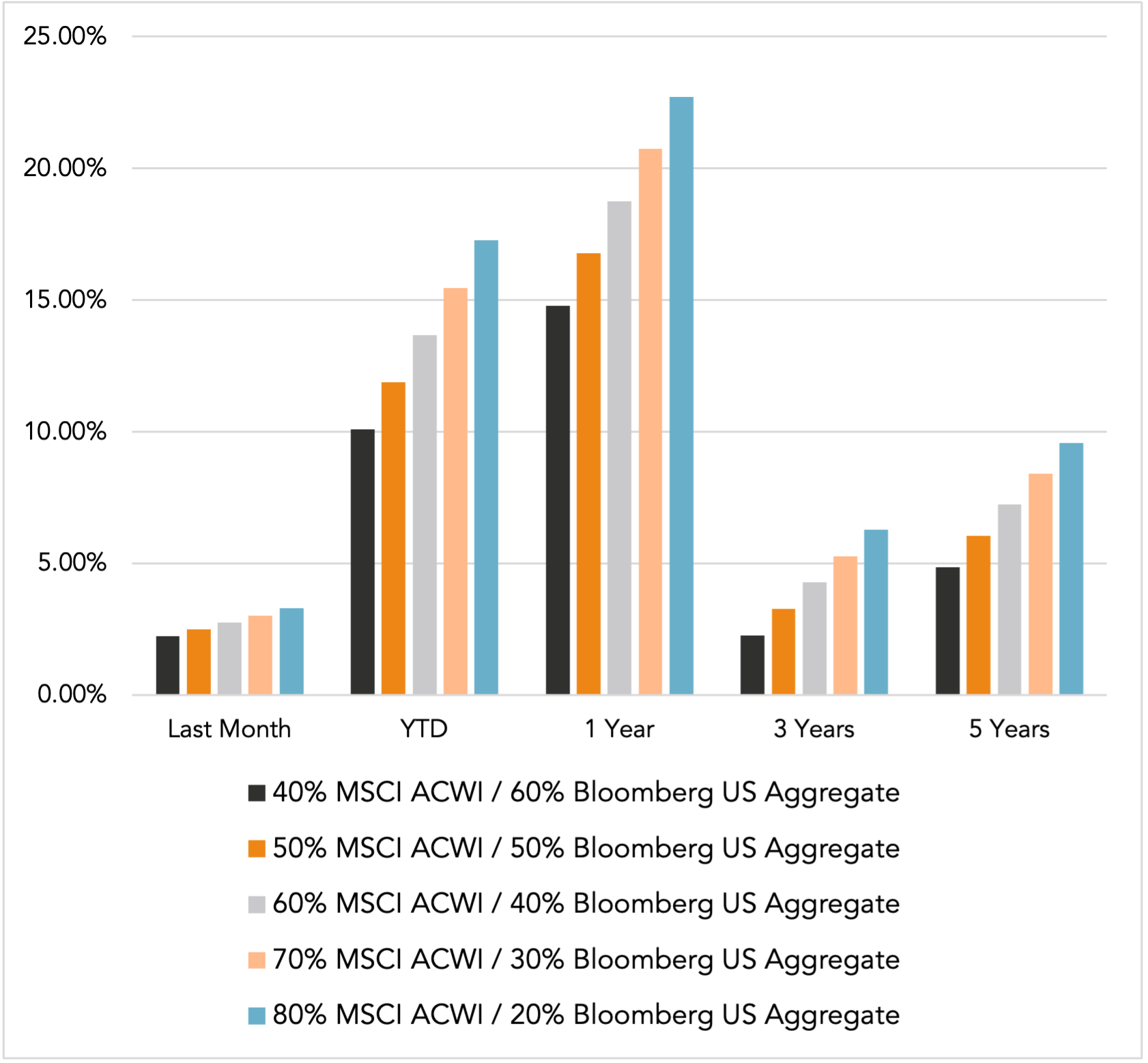

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

March 2025 Market Commentary