Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Resilience Amid Technological Disruption and Policy Shifts

Key Observations

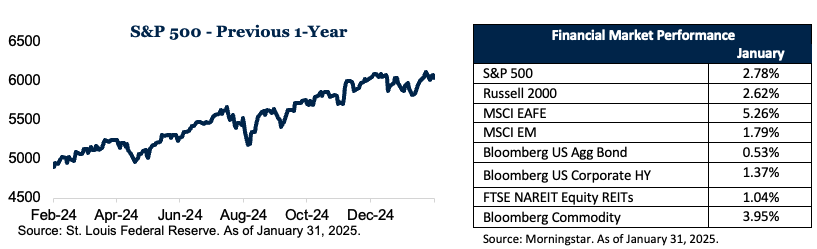

- The Dow Jones led major indices with a 4.8% gain, while the S&P 500 and Nasdaq followed with increases of 2.8% and 1.7% respectively. This marked the strongest January performance since 2023.

- DeepSeek R1’s launch caused significant market volatility, particularly in tech stocks. Nvidia notably experienced a dramatic single-day decline before recovering as investors seized buying opportunities.

- December’s lower-than-expected core inflation data sparked a market rally and boosted investor confidence. However, market gains were tempered at month’s end when President Donald Trump announced new tariffs targeting Canada, Mexico and China.

Market Recap

The first month of 2025 demonstrated the market’s remarkable adaptability in the face of technological disruption, economic data surprises and geopolitical developments. As we analyze January’s performance, several key themes emerged that will likely shape market dynamics for the remainder of the year.

Market Performance

January delivered a robust start to 2025, with the Dow Jones Industrial Average emerging as the standout performer, advancing 4.8%. The broader S&P 500 followed with a respectable 2.8% gain, while the technology-heavy Nasdaq Composite managed a more modest 1.7% increase. This divergence between indices reflects a notable rotation from growth to value stocks, as investors reassessed their positioning amid evolving market conditions.

Artificial Intelligence: Disruption and Opportunity

The month’s most significant development came from the artificial intelligence sector, with the unexpected release of DeepSeek R1. This technological breakthrough triggered substantial market volatility, particularly affecting industry leader Nvidia and other AI-related stocks. The initial market reaction demonstrated both the sector’s sensitivity to technological advancement and investors’ concerns about potential disruption to established market leaders.

The sell-off in Nvidia, while dramatic, proved temporary as investors viewed the correction as a buying opportunity. This price action revealed two important insights: first, the market’s growing maturity in handling AI-related developments, and second, investors’ continued confidence in established players despite new competitive threats.

Macroeconomic Environment and Policy Implications

December’s Consumer Price Index report provided a welcome surprise, showing core inflation trending lower than consensus expectations. This data point proved particularly significant as it suggested the Federal Reserve’s aggressive monetary policy stance has been effective in containing inflationary pressures without triggering a hard landing.

Corporate earnings have shown remarkable resilience, with fourth-quarter projections indicating a 13.2% year-over-year increase. This strong earnings growth, combined with moderating inflation, creates a supportive environment for equity valuations. However, the sustainability of these earnings trends will be closely watched as companies navigate rising input costs and potential margin pressures.

Trade Policy and Global Markets

The month’s conclusion brought unexpected complexity with Trump’s announcement of new tariffs targeting Canada, Mexico and China. This development introduced fresh uncertainty into global trade relations and supply chain dynamics. While the tariffs targeting Canada and Mexico have now been delayed by a month, trade policy has come to the forefront as a source of potential market volatility ahead as companies and investors adjust to this new trade landscape.

Navigating the Path Forward

As January 2025 draws to a close, the month’s market behavior reinforces the philosophy that strategic asset allocation remains the cornerstone of successful long-term investing. Despite significant headlines—from AI breakthroughs to trade policy shifts—broad market indices demonstrated their ability to process and adapt to new information efficiently. The divergent performance across major indices highlights the importance of maintaining diversified exposure across market segments rather than attempting to time sector rotations or react to short-term news flow. While technological disruptions and policy changes may create temporary volatility, January’s overall positive performance underscores a fundamental market principle: patient investors who maintain consistent exposure through well-diversified portfolios are best positioned to capture long-term market returns, regardless of near-term developments.

Disclosures:

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or recommendation. References to specific asset classes and securities are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell any securities or assets classes.

The commentary represents an assessment of the market environment through January 2025. The views and opinions expressed may change based on the market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize. We cannot guarantee the accuracy or completeness of any statements or data contained herein.

Diversification is an investment strategy designed to help manage risk, but it cannot ensure a profit or protect against loss in a declining market.

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Index Definitions: The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index. MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs. Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume, and 1/3 by world production and weight-caps are applied at the commodity, sector, and group level for diversification.

Does past performance matter?

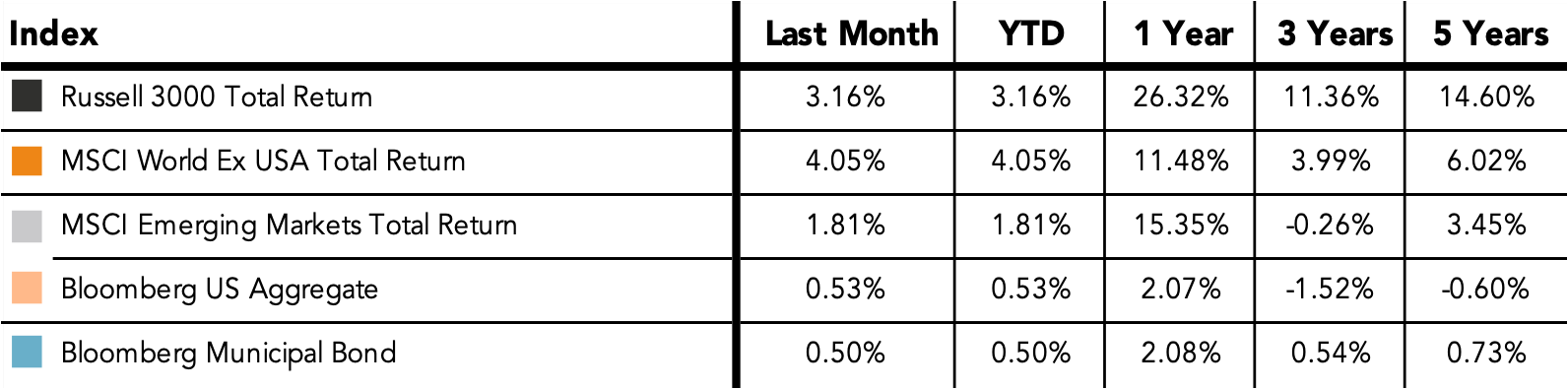

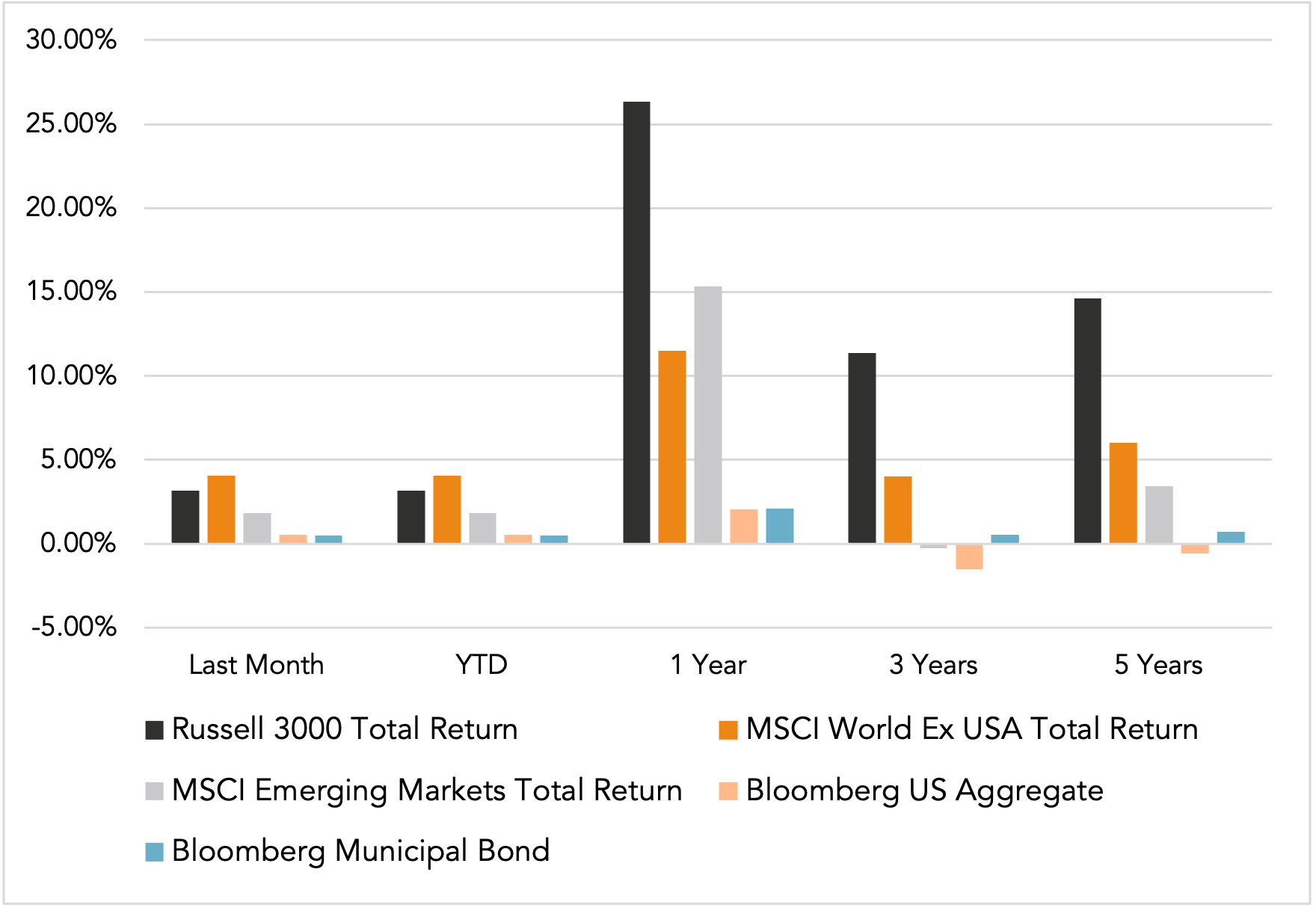

Major Market Index Returns

Period Ending 2/1/2025

Multi-year returns are annualized.

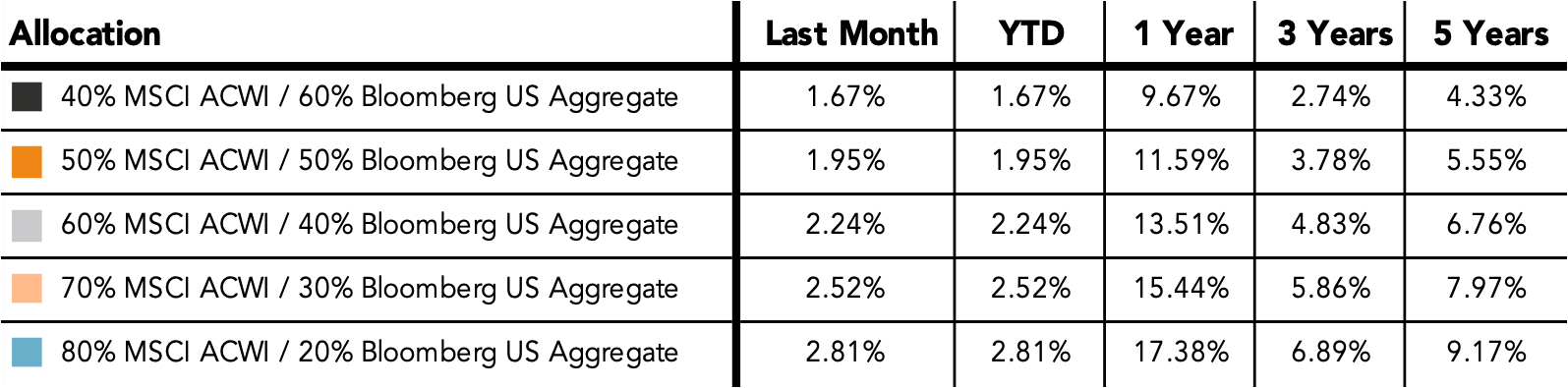

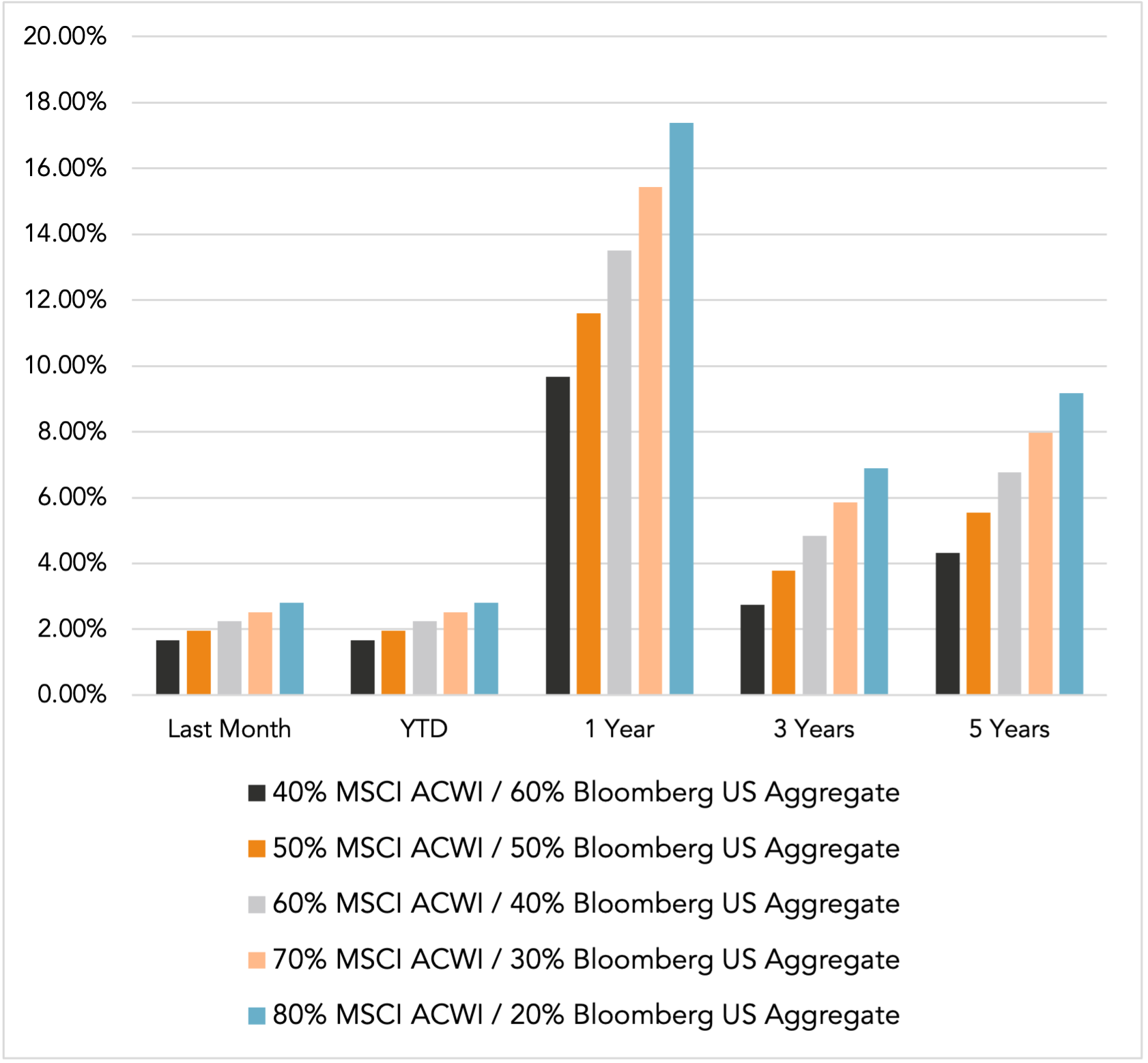

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

March 2025 Market Commentary