Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Key Observations

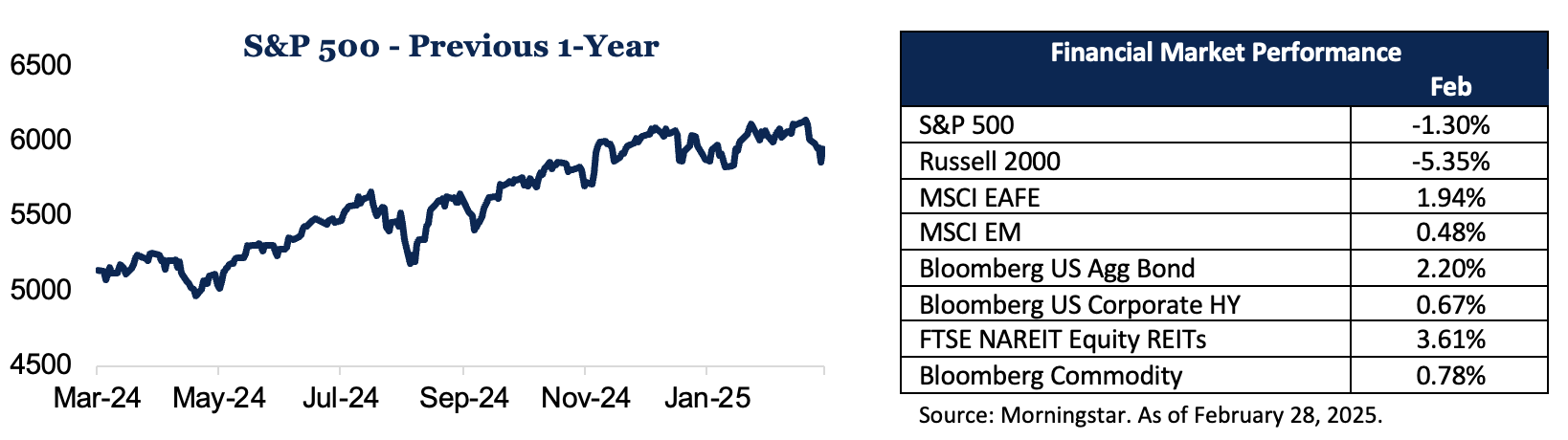

- Major indices declined with the Nasdaq dropping 3.9%, the S&P 500 falling 1.3% and the Dow Jones down 1.4%.

- A significant market rotation occurred away from technology stocks toward healthcare, consumer staples and financials, partly triggered by competitive pressures in the AI sector.

- Market volatility spiked due to President Donald Trump’s new tariff announcements, Federal Reserve policy uncertainty and concerns about Nvidia’s future profit margins despite strong revenue growth.

The month of February 2025 proved to be a turbulent period for financial markets, with significant movements across major indices and sectors. This newsletter examines the key developments that shaped market performance and offers perspective on navigating the current investment landscape.

Market Recap

Major Indices Post February Declines

February 2025 concluded with losses across all major U.S. stock indices, despite a rally on the final trading day of the month. The Nasdaq Composite experienced the most severe decline, falling approximately 3.9%. The S&P 500 dropped about 1.3%, while the Dow Jones Industrial Average fell 1.4%.

This downturn is particularly notable given that just weeks earlier, the S&P 500 had reached all-time highs, with the Dow and Nasdaq similarly approaching record levels. The sudden reversal highlights how quickly market sentiment can shift. The final trading day of February saw a modest recovery, with stocks rising after the release of benign inflation data that showed price pressures easing in January.

The month’s volatility stands in stark contrast to January’s positive performance, when both the Dow and S&P 500 posted gains following December’s losses. This pattern of alternating monthly performance underscores the importance of maintaining a long-term perspective rather than reacting to short-term fluctuations.

Investors should note that despite February’s setbacks, the broader context remains one of a market that has been performing strongly in recent months. The Nasdaq, for instance, entered February on a three-month winning streak before encountering headwinds.

Market Rotation: Technology Struggles While Other Sectors Gain Ground

A significant development in February was the notable rotation away from technology stocks—particularly the mega-cap tech names that had dominated market performance in 2024. This shift represents a broadening of market leadership, both within the U.S. and globally.

The Magnificent Seven group of stocks has underperformed the other 493 companies in the S&P 500 by nearly 11% so far in 2025. This rotation was exemplified by Nvidia’s performance following its fourth-quarter earnings report. Despite topping consensus expectations, the AI chipmaker’s results didn’t exceed projections by as wide a margin as in previous quarters, causing its shares to tumble over 8% in a single day.

The technology sector’s struggles have coincided with outperformance in other areas of the market. European and Chinese equities have outpaced U.S. stocks thus far in 2025. Within the U.S. market, sectors that had previously lagged technology are now finding favor with investors.

This broadening of market leadership was anticipated by some market strategists entering 2025, suggesting that the extreme concentration of returns in a handful of technology stocks might give way to a more balanced market environment. For investors, this rotation underscores the value of maintaining diversified exposure across sectors and geographies rather than chasing recent winners.

Rising Market Volatility Driven by Policy Uncertainty

February’s market turbulence can be attributed to several interconnected factors that have increased uncertainty and risk perception among investors. Chief among these has been Trump’s trade policy announcements, which have raised concerns about potential inflationary impacts and global trade disruptions.

On Feb. 26, Trump confirmed that the previously announced 25% tariffs on imports from Canada and Mexico would take effect on March 4, following a one-month pause. Additionally, he indicated plans to impose an additional 10% tariff on Chinese imports. These announcements contributed significantly to market volatility.

Beyond trade policy, several other factors have fueled market uncertainty:

- Economic data has sent mixed signals, with some indicators suggesting a potential slowdown. The University of Michigan’s consumer sentiment index dropped to 64.7 in February, a decline of almost 10% from January and well below analysts’ expectations. Manufacturing activity grew slower than expected, and the services PMI fell into contraction territory at 49.7, its lowest level in more than two years.

- Inflation concerns have resurfaced, with consumers’ 10-year inflation outlook rising to 3.5%, the highest level since 1995. This has complicated the Fed’s interest rate policy outlook.

- Corporate guidance has raised some red flags, exemplified by Walmart’s disappointing sales and profit forecast for the current fiscal year.

The combination of these factors has created what market analysts describe as a “growth scare,” though many maintain that the U.S. economy remains fundamentally sound. For investors, the key takeaway is that market volatility is likely to persist as these policy uncertainties play out.

Navigating Uncertain Markets

As we reflect on February’s market performance, several important lessons emerge for investors. First, the rotation away from technology leadership reminds us of the cyclical nature of markets and the importance of maintaining diversified portfolios that aren’t overly concentrated in recently successful sectors or companies.

Second, the impact of policy decisions—particularly around trade and tariffs—highlights how quickly external factors can shift market sentiment. Rather than attempting to predict or react to every policy announcement, investors are generally better served by focusing on long-term fundamentals.

Third, the contrast between 2024 and 2025 market environments is instructive. 2024 was largely characterized by markets responding to expectations about future events (elections, central bank actions) while 2025 is shaping up to be a year when markets react to actual policy implementation and economic outcomes. This shift may create a different set of opportunities and challenges.

In this environment of heightened volatility, the time-tested principles of diversification, patience and discipline become even more valuable. Rather than making reactive decisions based on short-term market movements, investors should ensure their portfolios are aligned with their long-term goals and risk tolerance.

By maintaining perspective and adhering to sound investment principles, investors can navigate the current uncertainty while positioning themselves to benefit from future market developments.

Disclosures:

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or recommendation. References to specific asset classes and securities are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell any securities or assets classes.

The commentary represents an assessment of the market environment through February 2025. The views and opinions expressed may change based on the market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize.

Diversification is an investment strategy designed to help manage risk, but it cannot ensure a profit or protect against loss in a declining market. There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions..

Magnificent Seven refers to Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Index Definitions: The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index. MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs. Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume, and 1/3 by world production and weight-caps are applied at the commodity, sector, and group level for diversification. Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. Nasdaq Composite Index is a market capitalization-weighted index of common equities listed on the Nasdaq stock exchange. All indexes are unmanaged and cannot be directly invested into.

Does past performance matter?

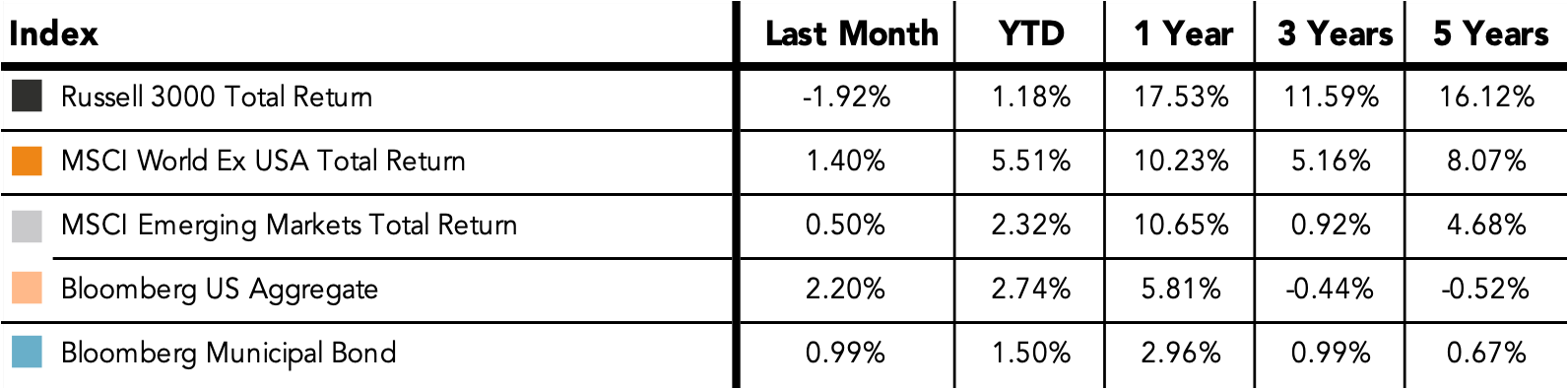

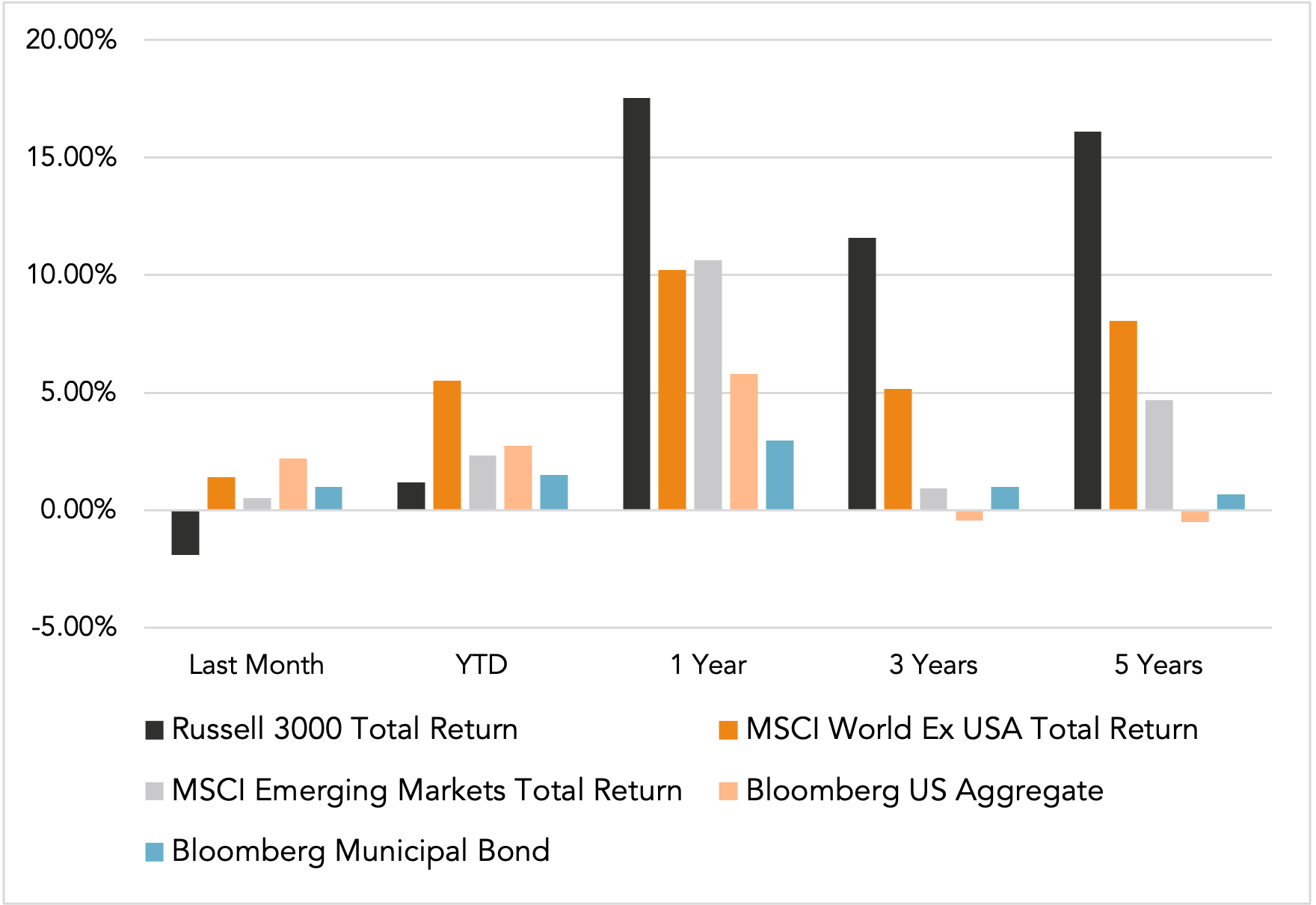

Major Market Index Returns

Period Ending 3/1/2025

Multi-year returns are annualized.

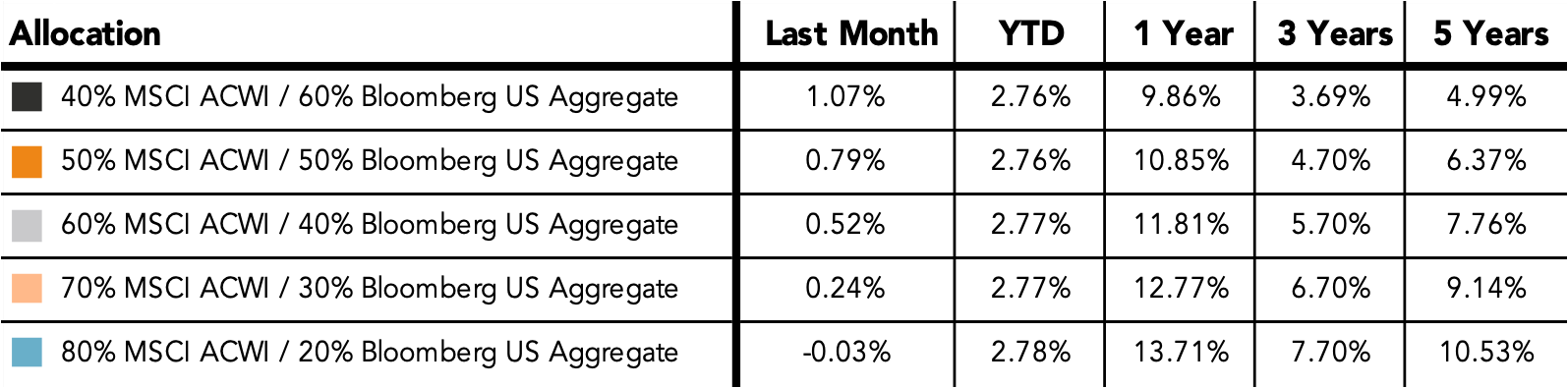

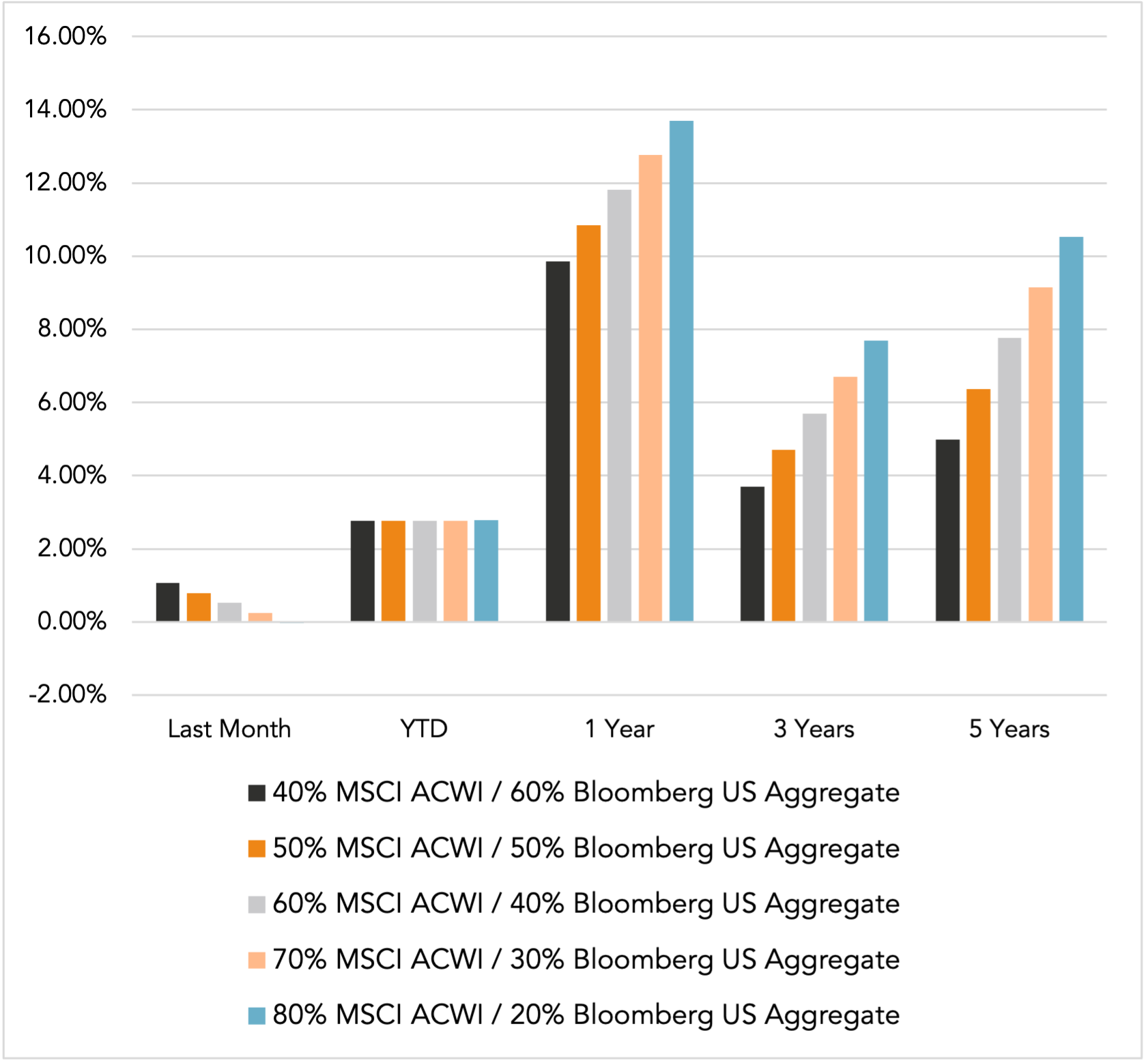

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

Market Update: March 2025 In Review