Homeownership has long been considered part of the American dream—a symbol of stability, security and accomplishment. That’s why it’s perhaps more than a little surprising that the Americans most able to afford to buy homes are increasingly choosing to rent.

Younger Generation Renting

Led by millennials and Gen Zers, the number of renters who earn more than $150,000 a year grew more than 80% between 2015 and 2020.1 For comparison, the total number of renters nationwide increased by just 3.2% during the same period.

Number of Million-Dollar Renters Triples

Among the 2.6 million high earners who rent are a skyrocketing percentage of millionaires. Individuals with at least $1 million in annual income choosing to rent tripled between 2015 and 2020 to a record 3,381. New York City alone accounted for 2,457 such households.2

Consistently High Home Prices Drive Renting

Why are wealthy Americans increasingly opting to rent rather than buy? While it’s impossible to say for sure, there are some compelling clues. One is the correlation between the growth of home prices and the increase in renting by high earners. Of the 10 cities where the high-income renter population grew the most, home prices grew fastest.

Consider that the average price of a single-family home in Seattle is about $850,000.3 That’s steep even for households earning, say, $200,000 or $300,000. San Francisco, with its limited housing supply and deep-pocketed tech executives, is even more expensive. A median home price in San Francisco is about $1.2 million.4 The city showed the biggest increase in millionaire renter households between 2015 and 2020. Its population of millionaire renters grew from 17 households in 2015 to 294 in 2020.5

Some Rent for the Lifestyle

But rising costs aren’t the only factor that might explain millionaires’ turn to renting. For many, renting may be an attractive lifestyle choice. By renting high-end properties or luxury apartments, “lifestyle renters” can enjoy upscale amenities, concierge services and a hassle-free living experience. This can allow them to focus on their careers, personal interests and travel.

Renting also eliminates headaches like property taxes, maintenance responsibilities and mortgage interest payments. And while homeownership is a good way for many to build wealth, millionaires might see more promising opportunities in other types of investments.

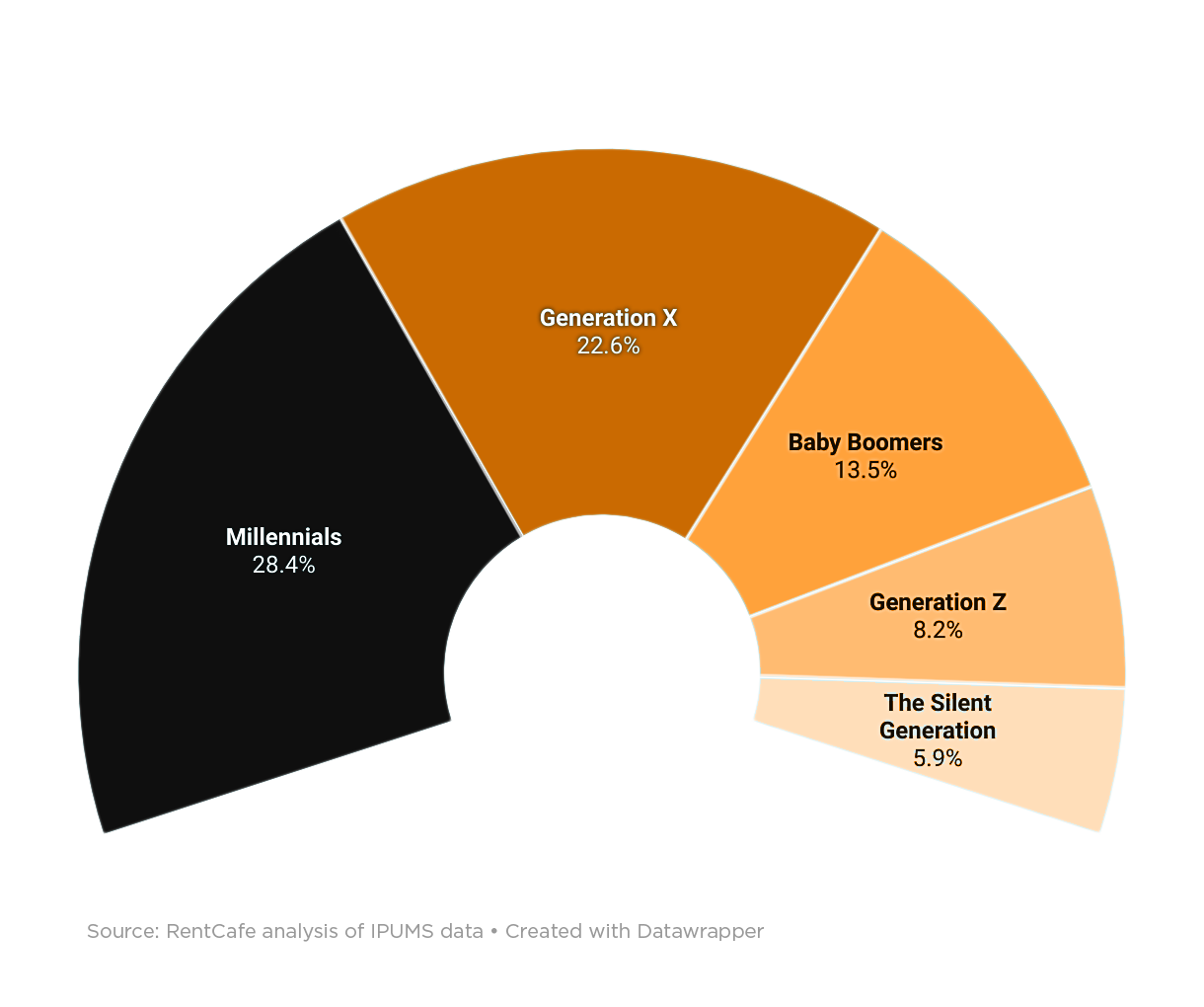

Renters by Generation

Who are these millionaire renters? As the chart illustrates, the biggest group is millennials (born between the early 1980s and the late 1990s), who make up 28% of the category. Gen Xers (born between the mid-1960s and 1980), make up 23%. Older generations stick more closely to traditional homeownership—just 13.5% of baby boomer millionaires rent.6

Which Are the Main Generations Among Millionaire Renters?

Talk With Your Wealth Advisor

For wealthy households, there’s no universally right answer to the question of whether to rent or buy. The calculus includes financial and economic factors but also personal preferences. If you’d like to talk through the options, including the financial pros and cons of each, your wealth advisor can help.

Footnotes

1,2“Millionaire Renters Triple”

3 “What is the average home price in Seattle?”

4“San Francisco Housing Market Report”

5,6“Millionaire Renters Triple”

This article is being provided for informational and educational purposes only. The information and opinions provided have been obtained from sources deemed reliable, but we make no representation regarding the accuracy or completeness of the information.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.