Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Rising Yields Bite

Surging U.S. job growth stoked inflation fears and sent longer-term interest rates to new 16-year highs. U.S. stocks tumbled while international stocks fell hard, led by China. Federal Reserve officials reiterated their intention to pause but said more interest rate hikes could still be necessary if inflation doesn’t slow. A hot war in the Middle East fueled geopolitical risks and sent oil prices higher.

Key Observations

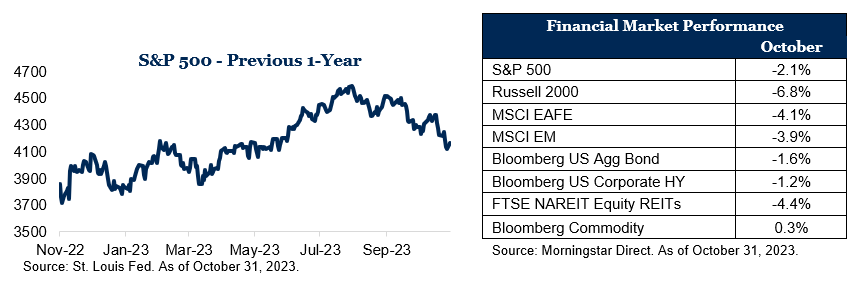

- The S&P 500 lost nearly 2% in October, though the market is up more than 10% year to date.

- Small-cap stocks fell nearly 7% and mid-cap stocks lost 5% for the month.

- Bonds ended the month down about 1.5%.

- International developed and emerging markets fell 2%-3% in October.

Market Recap

The stock market had another rough month in October as sectors most sensitive to the economy were hit hard. The S&P 500 lost about 2.1% during the month, though it is still up over 10% year to date, driven primarily by a more than 34% year-to-date gain in technology stocks. The Bloomberg U.S. Aggregate Bond Index was down about 1.5% for the month, while the 10-year Treasury yield increased. Yields on the 2-year Treasury declined at the end of October, starting at 5.05% and falling to 4.97% on October 31. The 10-year Treasury yield increased from 4.58% to 4.79%. High-yield bonds were down 1.2%, outperforming core bonds. Small- and mid-cap stocks fell 6.8% and 5.0%, respectively. International markets ended the month with losses as the U.S. dollar rose.

Hiring Surged in September

The latest sign of accelerating economic momentum stoked inflation fears and sent long-term Treasury yields to fresh 16-year highs. Employers added 336,000 jobs in September, the strongest gain since January and up sharply from the prior month’s upwardly revised 227,000 gain, according to the Labor Department. Bond and stock prices fell sharply after the report’s release, reflecting concerns that the Fed may need to hike rates more to tame inflation. Average hourly earnings rose 3.4% in September on a three-month annualized basis. The average 30-year fixed rate mortgage rose to 8.01%, the highest since 2000, according to the Mortgage Bankers Association. The unemployment rate held steady at 3.8% in September. Industries with unusually strong job gains included retail, construction and air transportation. Hiring was also solid at restaurants, hotels and nursing homes—all sectors still filling vacancies left by the pandemic.

The latest retail sales report, which shows spending at stores, online and at restaurants, rose a stronger-than-expected 0.7% in September from a month earlier. Consumers are spending on a range of items, including cars and vacations, despite feeling rather downbeat on the outlook. The consumer confidence index of expectations fell below 80 in September, a level that historically has signaled a recession within a year.

Strong spending and job growth is boosting economists’ optimism on the U.S. economy. Economists expect gross domestic product to increase 2.2% on average in the fourth quarter of 2023 from a year earlier. That is a sharp upward revision from the average 1% growth forecast in the last survey. Economists trimmed their forecast for next year, to 1% from 1.3%, but expect the economy to keep growing in 2024 and 2025.

The Consumer Price Index rose 3.7% in September from a year earlier, according to the Labor Department, the same as in August but far below peak inflation of 9.1% recorded in June 2022. Core prices rose 4.1% from a year earlier, down from 4.3% in August. They gained 0.3% in September for the second straight month after smaller gains in June and July. Fed officials in recent comments have signaled that they are likely to hold short-term interest rates steady at their next meeting, October 31-November 1, because the significant rise in long-term rates should slow the economy.

Gasoline prices rose less in September, but prices could rise again because of the war in the Middle East. Grocery prices continued their subdued trend of the past several months, while housing costs are beginning to show the effects of the Fed’s rate increases. The Fed has raised short-term rates to tame inflation by slowing the economy. That process is intended to drive longer-term bond yields higher, which lifts borrowing costs for businesses as well as homes, autos and other big-ticket items.

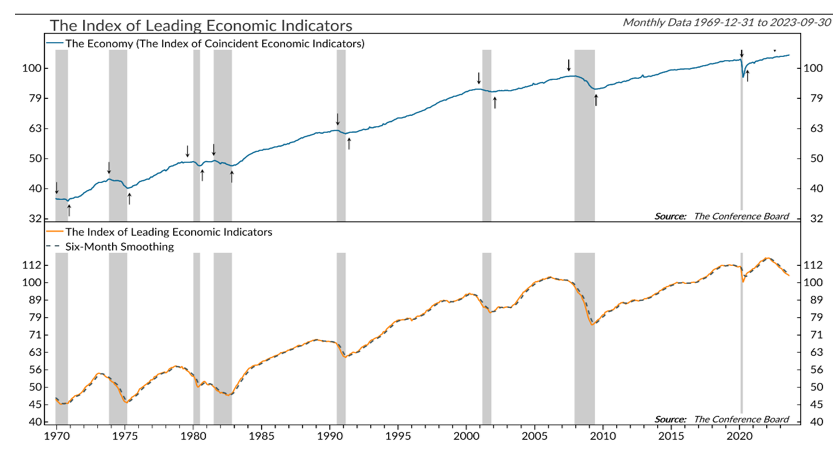

Where Is the Recession?

Source: Ned Davis Research. As of October 23, 2023.

The Conference Board’s Leading Economic Index (LEI) dropped 0.7% in September, exceeding the consensus of -0.5%. It was the LEI’s 17th-straight decline, and the largest since April, to its lowest level since June 2020. The LEI has been signaling recession for some time, but one hasn’t materialized. The Conference Board still expects a mild recession in the first half of 2024, though in the latest quarterly survey conducted by the Wall Street Journal, economists lowered the probability of a recession within the next year, from 54% on average in July to a more optimistic 48%. That is the first time they have put the probability below 50% since the middle of last year.

Outlook

War in the Middle East, rising oil prices, the risk of recession and declining stock and bond prices. One might say, “The future is filled with risks and uncertainties.” But when is this not the case? The future is always uncertain. Market sentiment is like a thermometer that moves from hot to cold. When the outlook is good and the mood on Wall Street is upbeat, stock prices tend to reflect that. The opposite is also true. What the stock market does not currently reflect is a resolution to our current problems. When that happens, stock prices are likely to be higher. That is the history of the stock market. Investment success does not depend on correctly guessing when the mood will change. Instead, it is almost totally dependent on developing a sensible long-term plan and having the discipline and the fortitude to stick to it in good times and bad. Benjamin Graham, known as the “father of value investing” and mentor to Warren Buffett, once said, “It is not immoral to speculate, but it is an unproductive waste of time.” Discipline is the investor’s greatest friend, time his greatest ally.

The mood on Wall Street changes very quickly, but, for most investors, their long-term goals remain unchanged. Traders are like a sailboat, adjusting each time the wind changes direction. But long-term investors are better off thinking like a battleship—staying the course no matter how difficult the conditions at sea. Although the impressive gains in the stock market this year have been trimmed a bit, investors who stayed the course after last year’s bumpy ride have been well rewarded. Our advice remains the same: Stay disciplined, stick to your plan and stay focused on your long-term goals.

Disclosures:

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or recommendation. References to specific companies, asset classes, and financial markets are for illustrative purposes only. Diversification is an investment strategy designed to help manage risk but cannot ensure a profit or protect against loss in a declining market. Please consult a financial professional before making any financial-related decisions.

The commentary represents an assessment of the market environment through October 2023. The views and opinions expressed may change based on the market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize. This commentary was written and provided by an unaffiliated third party; we cannot guarantee the accuracy or completeness of any statements or data contained herein.

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Index Definitions: The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index. MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs. Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume, and 1/3 by world production and weight-caps are applied at the commodity, sector, and group level for diversification.

The Leading Economic Index (LEI) consists of 10 components that indicate the short-term future course of various sectors of the economy, combined into a composite indicator of general economic performance.

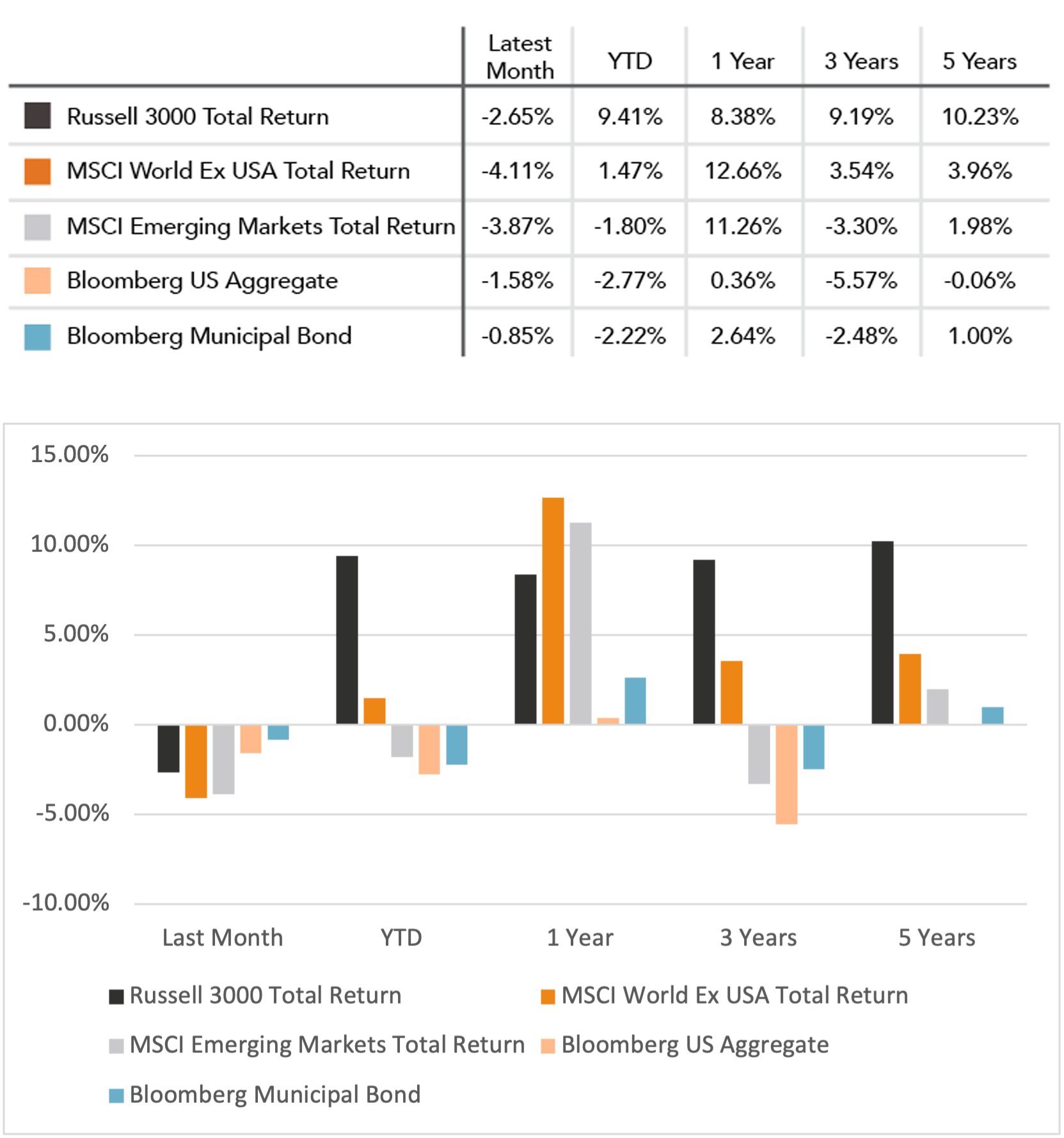

Does past performance matter?

Major Market Index Returns

Period Ending 10/1/2023

Multi-year returns are annualized.

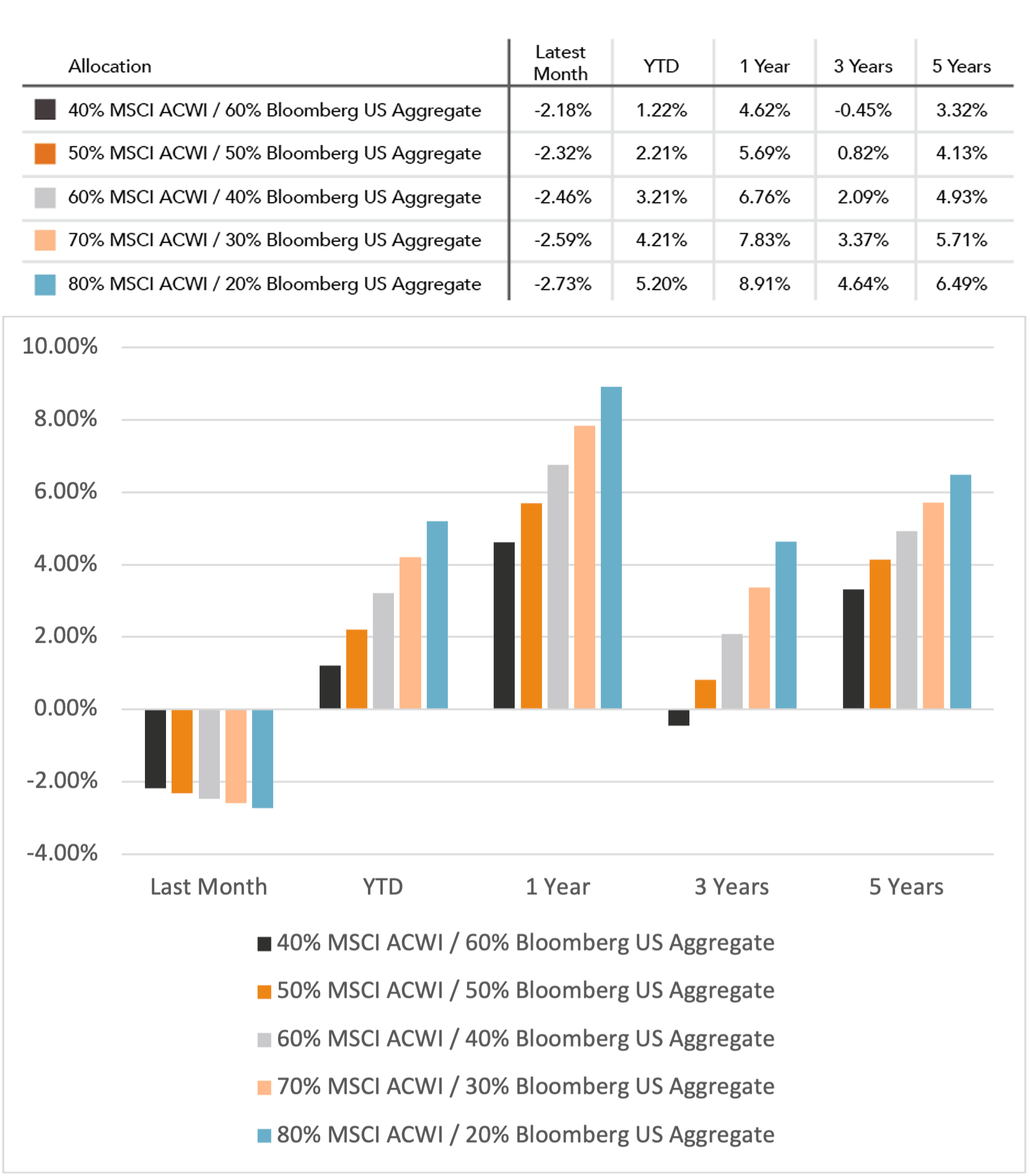

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

December 2024 Market Commentary