Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

The Fed Pivot

The Fed cuts by 50 basis points

The Fed’s policy shift fuels the market to continue its strong 2024

Key Observations

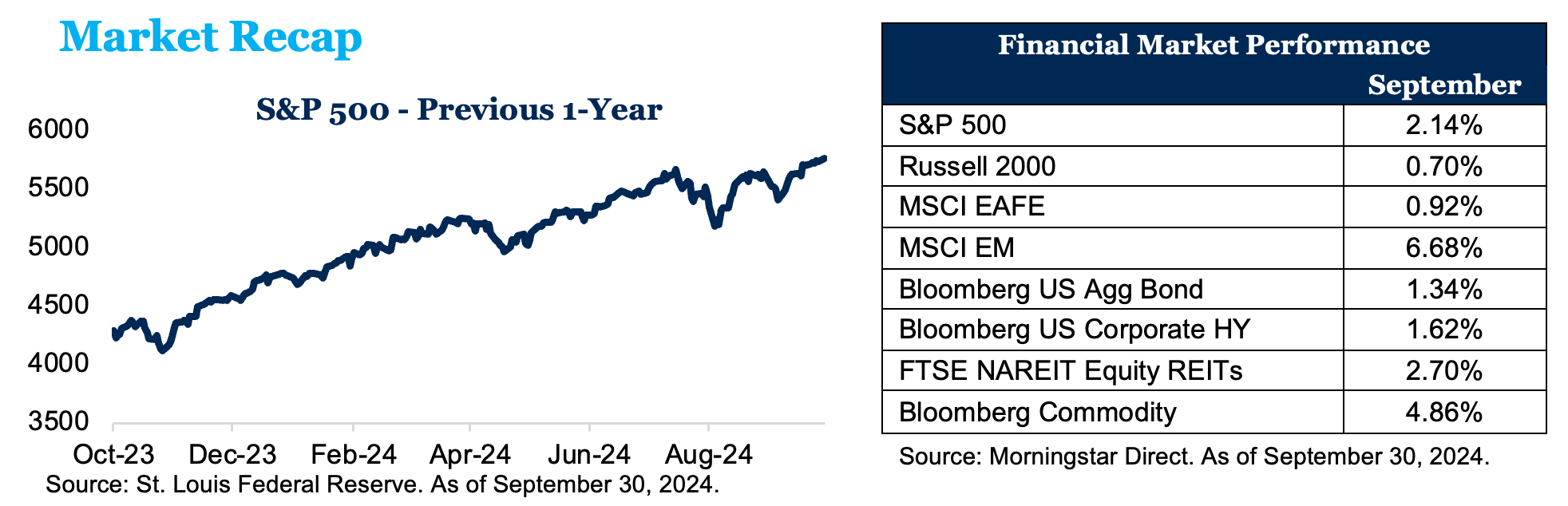

- The S&P 500 gained another 2.1%, bringing its year-to-date return to 22%.

- Emerging markets were up 6.7%, led by the Chinese market, which advanced nearly 24%.

- Bonds gained 1.3%, bringing their return for 2024 to 4.45%.

- International developed markets added just shy of 1%.

Market Recap

Market Recap

The U.S. stock market performed well again in September, adding 2.1% to bring its return to over 22% year to date. Consumer discretionary stocks led the way, gaining 7.4%. Energy stocks continued to struggle, down 3% for the month and up only 6.2% for the year, lagging the broader market by a wide margin. Small-cap stocks edged slightly higher by 0.7%, while mid-caps returned 2.2%, marginally outpacing large caps. Non-U.S. developed equities added 0.9%, while emerging market stocks had a huge month, advancing 6.7%, led by China’s stock market, which surged nearly 24% in September on aggressive monetary easing and stimulus measures from Beijing. The Bloomberg U.S. Aggregate Bond Index also had a positive return for the month, rising 1.3%, while the 10-year Treasury yield fell from 3.91% at the start of the month to 3.74% at month-end. Yields on the 2-year Treasury dropped as well, starting at 3.93% and declining to 3.62%.

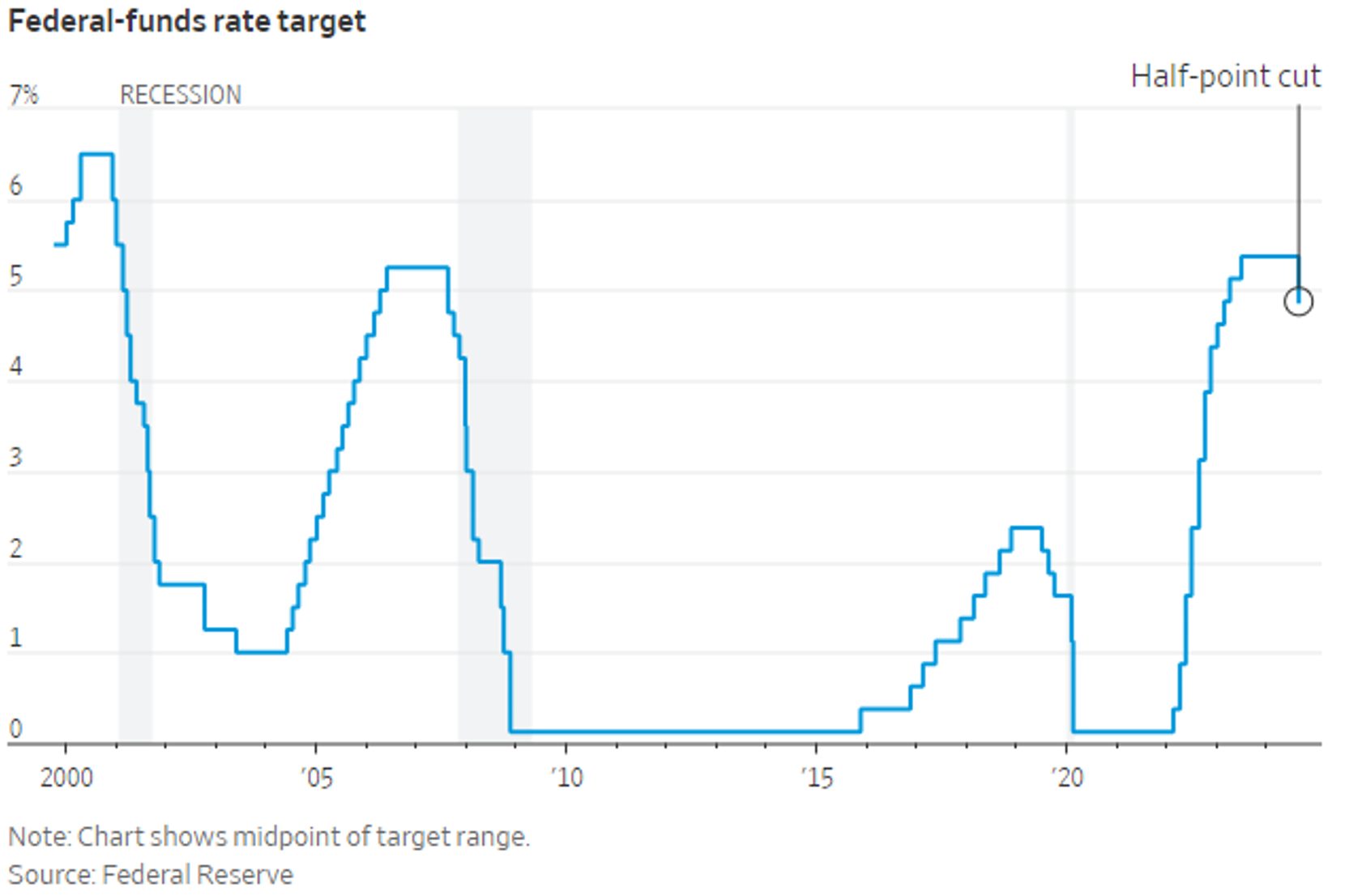

The Fed Cuts by 50 Basis Points

U.S. Federal Reserve (Fed) officials have officially shifted their focus from fighting inflation to prioritizing stabilizing the labor market with their first fed funds rate cut since 2020, bringing the rate down to a range of 4.75% to 5%. The Fed opted for a bolder move in cutting by 50 basis points (bps) instead of 25 bps. Additionally, as seen by the quarterly projections by a majority of officials, they are targeting quarter-point rate reductions in both November and December. After the announcement, Fed Chair Jerome Powell said, “This decision reflects our growing confidence that with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2%.”

This marks a new chapter for the Fed, which had started raising rates in 2022 to tame spiking inflation that was driven by supply chain issues and major demand from consumers during the pandemic. Inflation climbed to its highest level since 1981, and, as a result, the Fed increased rates 11 times. Inflation has now calmed, although not quite reaching the Fed’s 2% target. The labor market has weakened some, but there is still no clear sign that the U.S. is in a recession or is nearing one. Layoffs have remained low and consumers are still spending, but the excess savings that fueled that pace of spending has now largely dried up. As expected, the market responded positively to this news, with nearly all the S&P’s monthly gains coming after the announcement.

This marks a new chapter for the Fed, which had started raising rates in 2022 to tame spiking inflation that was driven by supply chain issues and major demand from consumers during the pandemic. Inflation climbed to its highest level since 1981, and, as a result, the Fed increased rates 11 times. Inflation has now calmed, although not quite reaching the Fed’s 2% target. The labor market has weakened some, but there is still no clear sign that the U.S. is in a recession or is nearing one. Layoffs have remained low and consumers are still spending, but the excess savings that fueled that pace of spending has now largely dried up. As expected, the market responded positively to this news, with nearly all the S&P’s monthly gains coming after the announcement.

The Chinese Market Roars Back to Life

After many months of trying to fix the economy with small policy support measures, China’s top leadership unleashed a massive wave of easing measures in late September. Prior to this move, the country had seen poor numbers on jobs, spending and inflation, all while being in a low-growth slump and a real estate crisis. The data was pointing to the Chinese economy’s missing its growth target of around 5% for the year. In response, leadership made several large moves to support the economy and the stock market. The biggest was that its central bank announced plans to cut interest rates and inject billions of yuan into the stock market while pledging to inject even more if needed. Additionally, central bankers said they would cut interest rates on existing mortgages and lower down payments needed for second homes.

Refinancing has historically been exceedingly difficult in China. To stimulate the stock market, the central bank announced it would also offer substantial loans to many parties to buy Chinese stocks and that it would help finance share buybacks for listed companies as well. These measures sparked trading in the Chinese market significantly and sent shares much higher, ultimately leading the market to soar 24% for the month.

Disclosures:

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or recommendation. References to specific asset classes and securities are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell any securities or assets classes.

The commentary represents an assessment of the market environment through September 2024. The views and opinions expressed may change based on the market or other conditions. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially. This commentary was written and provided by an unaffiliated third party; we cannot guarantee the accuracy or completeness of any statements or data contained herein.

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Index Definitions: The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index. MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs. Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume, and 1/3 by world production and weight-caps are applied at the commodity, sector, and group level for diversification. Russell 2000 Value Index tracks the performance of Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. Russell Top 50 Index also known as the Russell Top 50 Mega Cap is a stock market index that measures the performance of the largest companies in the Russell 3000 Index.

Does past performance matter?

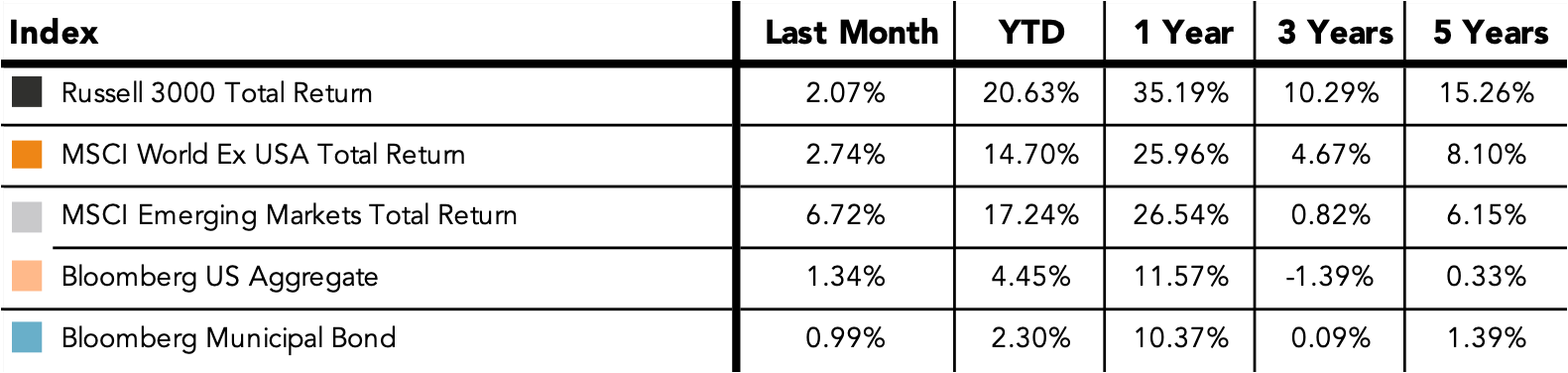

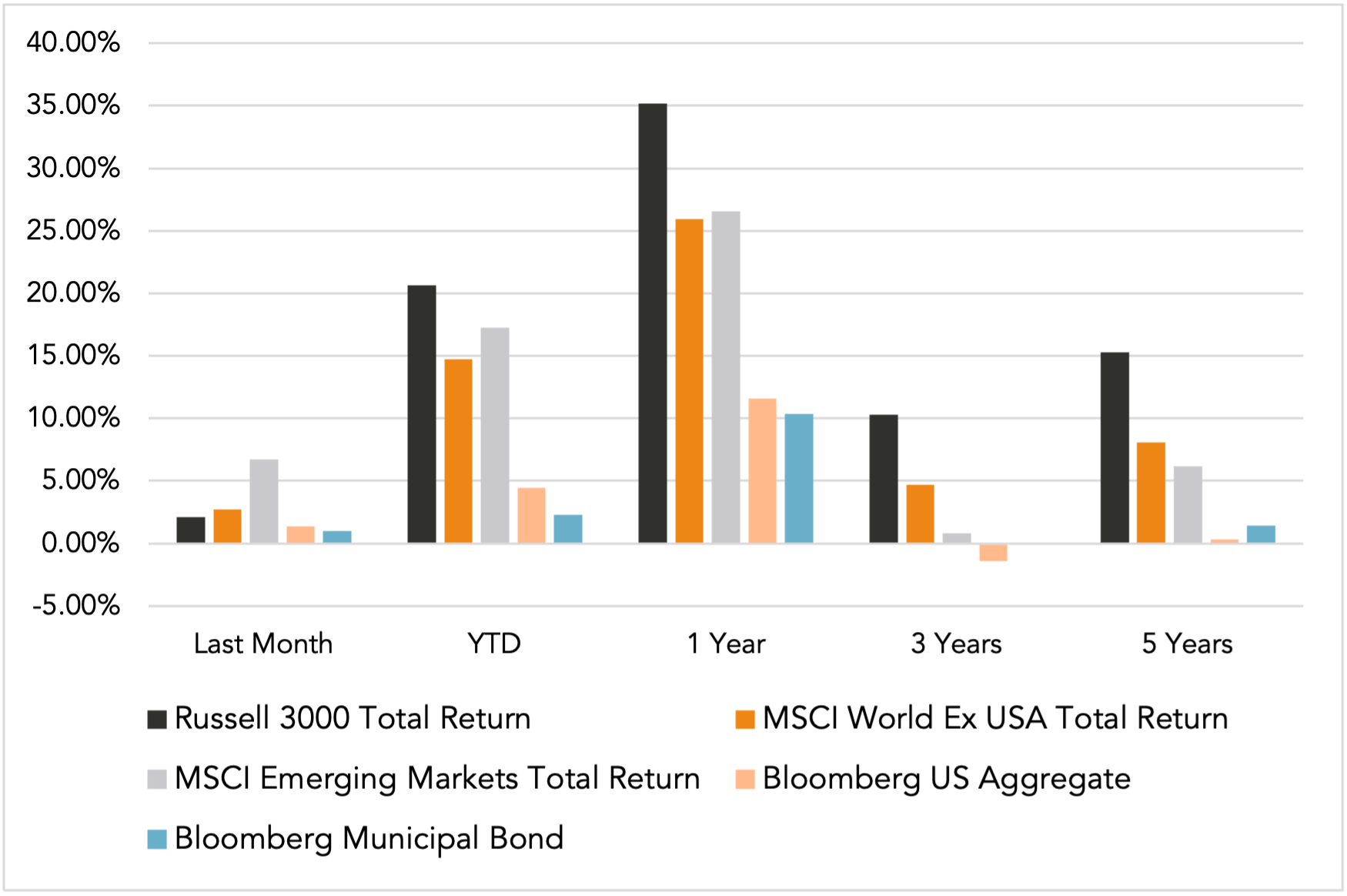

Major Market Index Returns

Period Ending 10/1/2024

Multi-year returns are annualized.

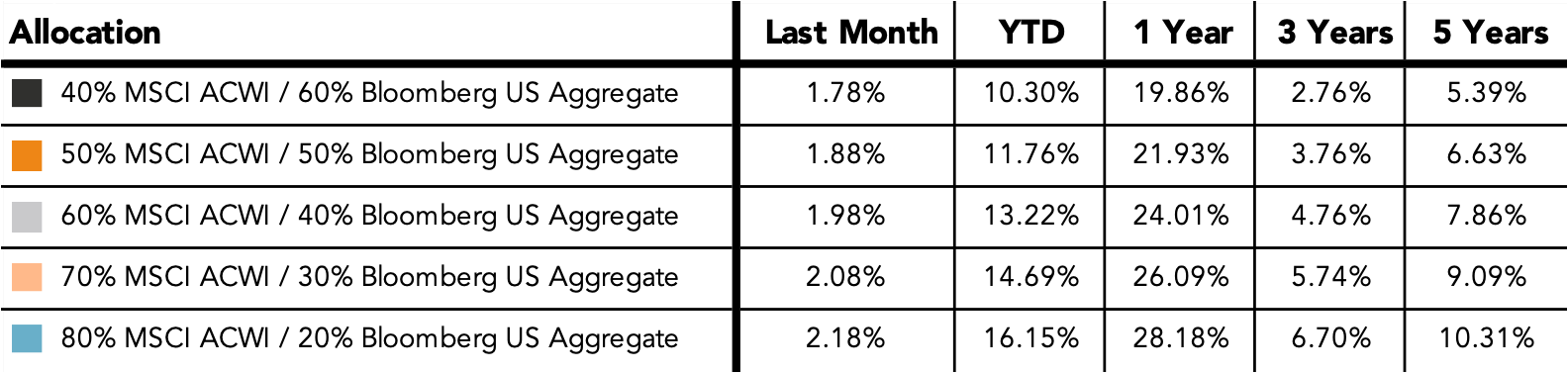

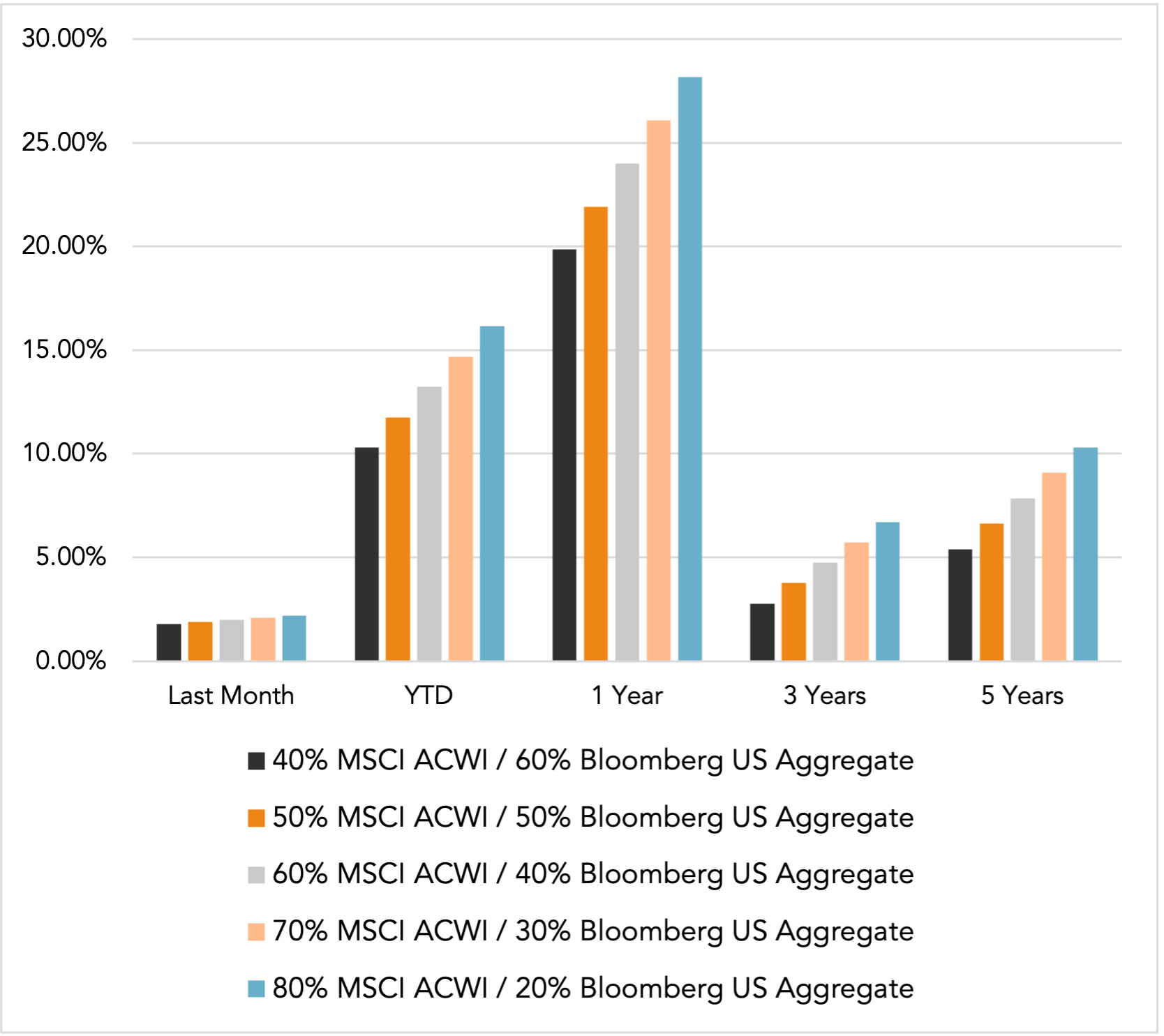

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

November 2024 Market Commentary