Americans’ perception of the age at which they plan to retire often differs from their reality. Most will retire several years earlier than planned, which is why it makes sense to be proactive about saving for retirement.

People Typically Retire at 62

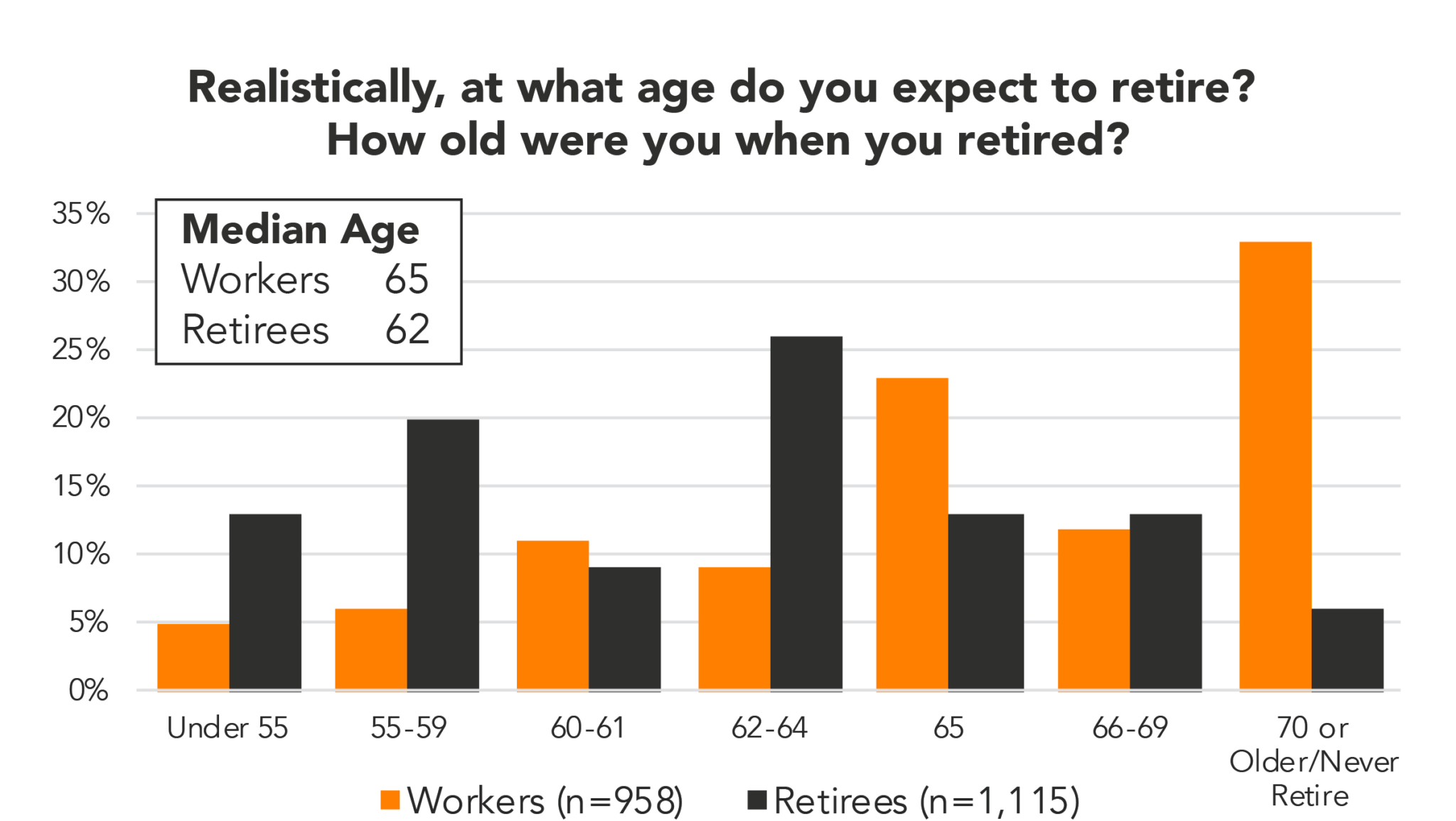

The median worker expects to retire at age 65, according to a retirement confidence survey.1 The survey found, however, that retirees left the workforce at a median age of 62. While 33% of workers said they planned to retire at age 70 or later—or not at all—just 6% of retirees waited that long.

Workers’ Expected Retirement Age vs. Actual

Figures and n-sizes presented exclude those who answered, “Don’t know,” said they never worked or refused to answer.

Source: Employee Benefit Research Institute and Greenwald Research, 2023 Retirement Confidence Survey

Early Retirement and Working in Retirement

While 11% of workers surveyed said they planned to retire before age 60, three times that number (33%) of retirees said they stopped working that early. Meanwhile, 73% of workers said they plan to work for pay in retirement, while just 30% of retirees reported that they’d done so.2

People retire early for all sorts of reasons. High earners may retire early because they can afford to, while others may leave the workforce and choose not to work in retirement due to a health challenge or disability.

Considerations About Longevity

A successful early retirement strategy hinges on you having enough income to last throughout your lifetime. First, start by estimating your life expectancy. No one can say for sure how long they’ll live, of course. As of 2023, life expectancy in the U.S. was 79.11.3 Your family’s health and longevity should also factor into your estimate.

Estimating Your Rate of Return

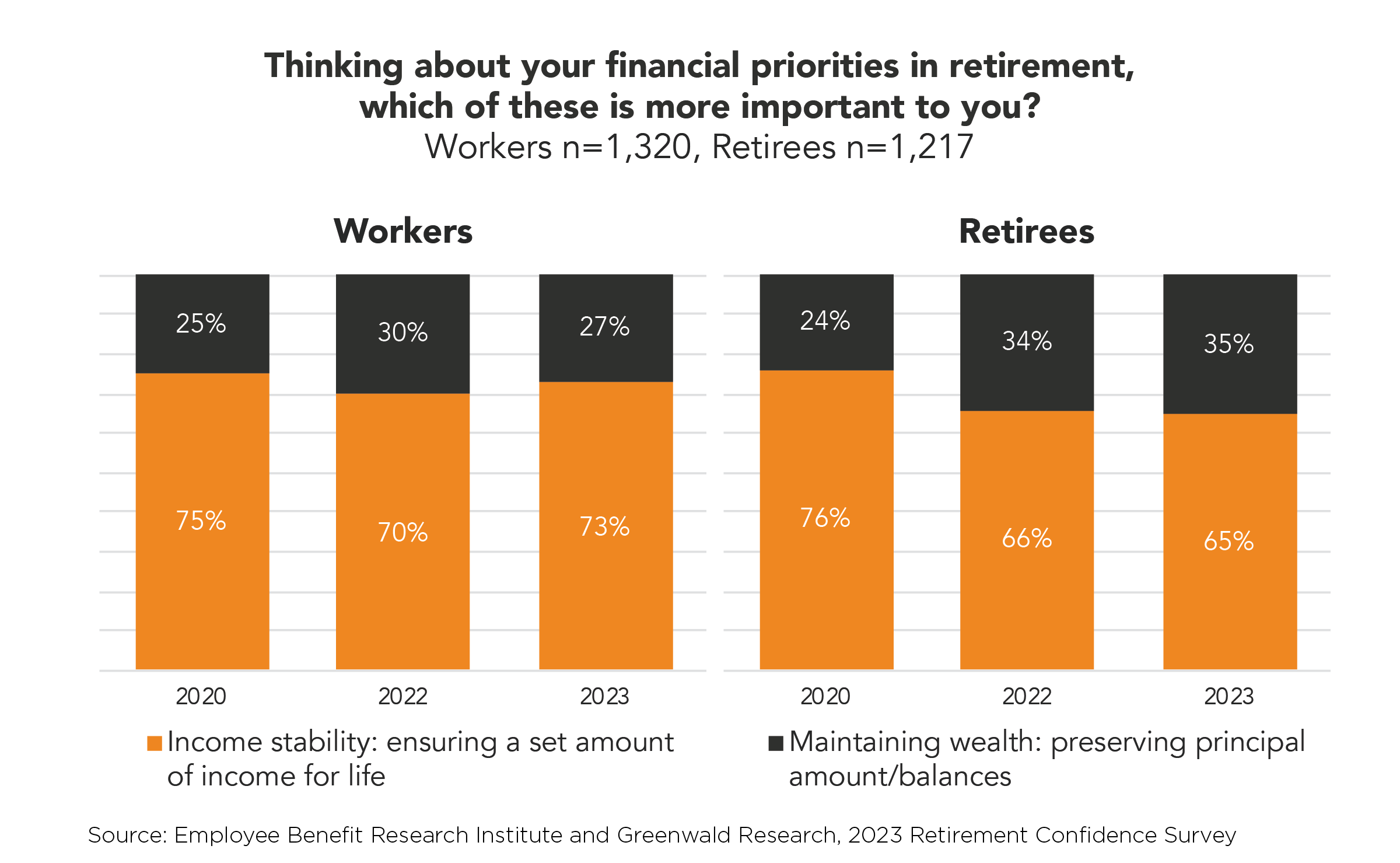

Appreciation from your assets should help you fight inflation as you build your retirement income. Calculating an estimated rate of return based on historical averages can give you an idea of how long your funds could potentially last throughout your lifetime. Market results will vary from year to year, of course. Your wealth advisor can run scenarios based on different hypothetical market conditions to estimate potential investment return. Your advisor can also work with you to build a cash flow plan based on your current expenses and expected sources of income in retirement. As the chart illustrates, workers and retirees alike prioritize income stability in retirement.

Income Stability a Top Retirement Priority

Early Withdrawals From Certain Retirement Accounts

The earliest age you can generally withdraw money from a 401(k) or traditional IRA without incurring a 10% penalty is 59½, but there are exceptions. If you leave your company after age 55 and before age 59½, you may be able to tap your 401(k) penalty free. Another strategy for avoiding early withdrawal penalties from traditional IRAs and 401(k)s if your retirement plan allows it is to withdraw income in the form of substantially equal periodic payments (SEPP).4 Be sure to contact your employer or plan sponsor to determine whether this option is available to you. If it is, note that you must commit to a series of similar-sized withdrawals from your IRA or 401(k) at least once a year on a schedule that remains in place for at least five years or until you turn 59½, whichever is longer. Remember that distributions are still taxable under both strategies.

How Roth IRAs May Help

Owners of Roth IRAs may withdraw their contributions anytime. Because the accounts are funded with after-tax dollars, doing so does not trigger penalties or taxes. Be careful, though—you must wait at least five years to withdraw earnings penalty free.* In some cases, those who are planning to retire early may want to consider converting their traditional IRA into a Roth IRA. Doing so will trigger a tax bill in the year of the conversion, so it may make sense to wait until retirement, when you may be in a lower tax bracket. Roth IRAs also offer estate planning advantages, including tax-free wealth transfers to heirs.

Budget for Health Care Expenses

You can cover health care costs in retirement using balances accrued in an employer-sponsored health savings account (HSA). These accounts are portable, and retirees can use them to pay for eligible medical expenses. After age 65, the funds can be used to pay for anything you’d like; however, if funds are used for nonmedical purposes, those withdrawals will be subject to income tax. To have an HSA, you’ll need to pair it with a high-deductible health plan (HDHP).

Another way to pay for health care in retirement is by purchasing a private insurance policy or by taking advantage of an employer-provided COBRA plan, assuming you meet the conditions to qualify for it. A common reason is voluntary or involuntary termination of employment. COBRA provides insurance for up to 18 months. If you’re married, being added to your spouse’s plan would also be an option for funding health care expenses.

Your Wealth Advisor Can Help

Your wealth team is here to help you map out a strategy for retiring with confidence, even if it ends up happening earlier than you expect.

Sources

1,2“2023 RCS Fact Sheet: Expectations About Retirement”

3“Macrotrends, U.S. Life Expectancy 1950-2024”

4“Substantially Equal Periodic Payments”

Disclosures

*A distribution from a Roth IRA is tax free and penalty free, provided the five-year aging requirement has been satisfied and one of the following conditions is met: age 59½, disability, qualified first-time home purchase or death.

This article is being provided for informational and educational purposes only. It should not be construed as an individualized recommendation or personalized advice. Please contact your financial, tax, and legal professionals for more information specific to your personal situation. The information and opinions provided have been obtained from sources deemed reliable, but we make no representation regarding the accuracy or completeness of the information.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.